![]()

The BIM Period end consists of a series of tasks that calculate values and move costs through the system. There is an option to define the granularity of the period end process to the entity, house or pen level. The system also has the ability to define allocation definitions for administration and service departments to allocate the costs to the entities in the period. There are several allocation basis that may be used for the administration and services costs to provide added flexibility.

The following are the steps that must be completed and balanced prior to starting the period end process. This is the most important section of the implementation process as if the beginning balances are not accurate, the MTech period end process will not generate the correct data.

The following details are validated/entered in the month prior to the first period end. Any journal transactions should be entered on the last day of the period prior to the first period end to be generated in MTech. For example, if beginning to run period end in MTech on 01/01/2014, these transactions should be entered with a date of 12/31/2013. Period End tasks to review bird days and other costs will be generated for F2013-12.

The following details are outlined in this document.

The following are a list of items that can be reviewed to ensure that period end will run efficiently.

|

|

The Preliminary Task requires the user to run period end tasks for clearing balances and validation. These tasks are run for the period prior to the first period being run in MTech. For example, if the first period in MTech is 01/2014, then these tasks will be run for period 12/2013.

The first step in the process is to enter the beginning entity balances. These balances are entered on the last day of the period prior to the first period being run in MTech.

There are two options available to enter inventory balances:

The Inventory Valuation Wizard is a tool to enter beginning balances for entities. When the process is completed, the result is a journal transaction that creates an adjusting entry to record the inventory balances for the entity.

| Stage | Account | Product No | Comments |

| Brood | |||

| Debit | BRDR-BROOD-[OBJECT]-[ELEMENT]-IN | Not Required | Required for all brood expenses |

| Debit | BRDR-INV-FEED-ING-IN | Feed Formula | Required if feed inventory quantity is entered |

| Credit | SYS-GLNPOST-00000-00000-00000 | Not Required | Offset account |

Capitalized |

|||

| Debit | BRDR-CAPHEN-INV-BRDRFEMALE-IN | Not Required | Total capitalized cost |

Credit |

BBRDR-CAPHEN-ACMDEPR-BRDRFEMALE-IN | Not Required | Total accumulated depreciation |

| Credit | SYS-GLNPOST-00000-00000-00000 | Not Required | Offset account |

| Lay (only required if farm egg inventory exists) | |||

| Debit | BRDR-LAY-INV-EGGS-IN | Not Required | Egg inventory amount ** |

| Debit | BRDR-INV-FEED-ING-IN | Feed Formula | Required if feed inventory quantity is entered |

| Credit | SYS-GLNPOST-00000-00000-00000 | Not Required | Offset account |

| ** BRDR-LAY expenses can also be entered in detail by account if available | |||

There are two steps involved in implementing period end:

The configuration for period end is completed in the registry.

The following two items need to be defined if the Protein Cost Mode is set to Standard and Actual or Standard with Variance.

Allocation Definitions are created to allocated departmental and administration costs entities. Examples of such costs are service crews, cleanout and breeder administration. The Allocation Definition tool is flexible and has many pre-defined allocation basis.

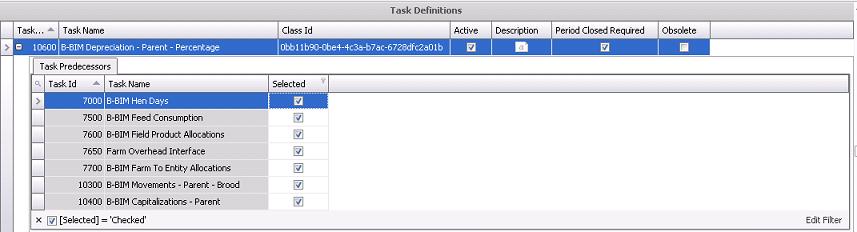

This process defines the predecessor tasks that must be run so that costs are defined in the proper order. Predecessors are used to establish two parameters related to period end.

Predecessors can only be established on tasks that appear in the list prior to the task that requires the predecessor. Period end tasks are defined in Admin>Business>General>Period End>Task Definitions.

to expose the

list of tasks available to set as a predecessor.

to expose the

list of tasks available to set as a predecessor. to save the Task Definition

list.

to save the Task Definition

list.Once all of the above steps have been completed and opening balances are verified, the period end process can be completed. There are a series of tasks required. For each of the steps, the following need to occur before moving to the next task.

** Note: In the BIM tasks, there are references to specific system reports for the B-BIM module basic tasks. If a system report is not available for a specific module, the report can be duplicated and modified as required.

The following tasks are outlined in this document for the BIM module:

The purpose of this task is to review all transactions and data in the system to ensure that period end can be processed. It is important that this task is run to ensure that all required data is included in the period end process. Not running this task can result in inaccurate costing data. The process verifies the following:

This task is only generated if FMIM is being used and there are overhead allocations to be allocated to feed deliveries. The task will allocate any overhead to period deliveries and ending inventory at the feed mill. There is an option to allocate overheads from a summary account or allocate in detail. All overhead to be allocated must be defined in Admin>Business>General>Period End>FMIM Overhead Mappings.

Calculate task.

Generate report 900 FMIM OPS Allocation (Journal Trans Summary) to verify all required accounts are zero. The net of all accounts should be zero unless accounts are not mapped in FMIM Overhead Mapping. If the balance is not zero, verify that all accounts in the report have been mapped. If there are any accounts that are required to be mapped, add to the overhead mapping and re-run the task. Generate report again to ensure balance is zero.

Click on the required log to view the details from the FMIM OPS Allocation task:

Summary:

| Credit | FDM-OPS-ALLOC-00000-OUT | Credit to allocate balance of defined overhead accounts |

| Debit | BRDR-INV-FEED-MAN-IN | Debit to feed deliveries for manufacturing costs |

| Debit | FDM-INV-FEED-MAN-IN | Debit to feed mill finished feed inventory for manufacturing costs |

Detail:

| Credit | FDM-OPS-[Object]-[Element]-OUT | Credit to allocate balance of defined overhead accounts |

| Debit | BRDR-INV-FEED-MAN-IN | Debit to feed deliveries for manufacturing costs |

| Debit | FDM-INV-FEED-MAN-IN | Debit to feed mill finished feed inventory for manufacturing costs |

The purpose of this task is to review all BMTS transactions and data in the system to ensure that period end can be processed. It is important that this task is run to ensure that all required data is included in the period end process. Not running this task can result in inaccurate costing data. There are no journals created from this task.

This task generates overhead estimates for standard costs incurred for BIM, HIM and BRIM. The overhead estimates are created in General> Products> Prices> Overhead Estimates. The task will create standard journals to debit the standard overhead and credit the actual overhead so that it can be used to calculate variances in movement tasks. This task is not used when the Protein Cost Mode is set to Actual.

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Debit | BRDR-[STAGE]-[OBJECT]-[ELEMENT]-IN | Standard Cost | Not Set | Records the standard overhead estimate calculated on the basis and rate in overhead estimated |

| Credit | BRDR-[STAGE]-[OBJECT]-[ELEMENT]-OUT | Actual Cost | Not Set | Removes the actual offset to the same account to be used in movements to calculate variances |

This task creates the standard journals for transfers, capitalization, transfers to plant and spent breeder journals. The journals are created based on rates entered in General>Product>Prices>Internal Prices>Animals. The standard journals for purchases is created at receiving. With the exception of spent breeders, the standard journals for sales is created at shipment. This task is not used when the Protein Cost Mode is set to Actual.

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-BROOD-[OBJECT]-[ELEMENT]-OUT | Standard Cost | Not Set | Records the standard capitalization transfer from brood |

| Debit | BRDR-CAPHEN-INV-[ELEMENT]-IN | Standard Cost | Not Set | Records the standard capitalization transfer to capitalized inventory |

| Credit | BRDR-CAPHEN-INV-[ELEMENT]-SLS | Standard Cost | Not Set | Records the standard salvage for spent breeders |

| Debit | BRDR-CAPHEN-INV-[ELEMENT]-SLS | Actual Cost | Not Set | Records the offset to actual expense to be used in movements to calculate variances |

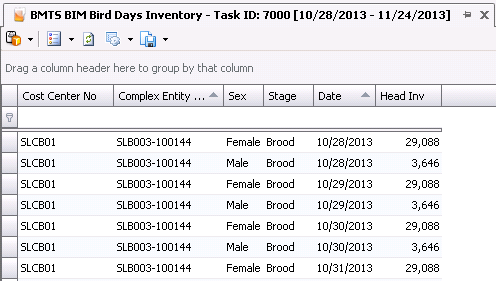

This task calculates the hen days incurred by entities in the current fiscal period. The bird days will be calculated by sex and stage. These values are used to allocate costs at various stages in the period end process. There are no journals created from this task, however the Bird Days Inventory Log can be reviewed by selecting task 7000 and right-clicking to select option.

The Feed Consumption task calculates the feed consumption based on the parameters defined in Configuration related to feed. Feed consumption may be calculated based only on feed deliveries or based on feed deliveries and inventory. As well, depending on the option defined in Registry>Poultry>PMTS>Broiler Breeder>General>Feed Inventory Mode, the journal may be created by product (Mode=Feed Type or Formula No) or a single amount for all feed deliveries (Mode=Single Inventory). If there are amounts allocated to Cost Elements MAN, DEL, LDG, MED and/or MEDSPCL, then these amounts will also be allocated in this process.

The following tasks affect how feed consumption is calculated:

The following log is generated when the period end task is run. Click on the task and right-click to select the log:

Protein Cost Mode=Actual

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-INV-FEED-ING-OUT | Actual Cost | Not Set | Removes the feed consumed ingredient cost from feed inventory |

| Credit | BRDR-INV-FEED-MAN-OUT | Actual Cost | Not Set | Removes the feed consumed manufacturing cost from feed inventory |

| Debit | BRDR-[STAGE]-FEED-ING-IN | Actual Cost | Not Set | Feed consumption ingredient cost by entity stage |

| Debit | BRDR-[STAGE]-FEED-MAN-IN | Actual Cost | Not Set | Feed consumption manufacturing cost by entity stage |

Protein Cost Mode=Standard and Actual Cost

| Trans Code | Account | Standard Cost Type |

Variance Type | Comments |

| Credit | BRDR-INV-FEED-ING-OUT | Standard Cost | Not Set | Removes the standard feed consumed ingredient cost from feed inventory |

| Debit/Credit | BRDR-INV-FEED-ING-OUT | Price Variance | Feed Production | Removes the feed consumed ingredient adjustment cost from feed inventory |

| Credit | BRDR-INV-FEED-MAN-OUT | Standard Cost | Not Set | Removes the standard feed consumed manufacturing cost from feed inventory |

| Debit/Credit | BRDR-INV-FEED-MAN-OUT | Price Variance | Feed Overhead | Removes the feed consumed manufacturing adjustment cost from feed inventory |

| Debit | BRDR-[STAGE]-FEED-ING-IN | Standard Cost | Not Set | Standard feed consumption ingredient cost by entity stage |

| Debit/Credit | BRDR-[STAGE]-FEED-ING-IN | Price Variance | Feed Production | Adjustment for feed consumption ingredient cost by entity stage |

| Debit | BRDR-[STAGE]-FEED-MAN-IN | Standard Cost | Not Set | Standard feed consumption manufacturing cost by entity stage |

| Debit/Credit | BRDR-[STAGE]-FEED-MAN-IN | Price Variance | Feed Overhead | Adjustment for Feed consumption manufacturing cost by entity stage |

BIM Field Product allocations are used to allocate field products that have been delivered at the farm to the entity stage. There is an option to automatically create a usage when field products are received to the farm when farm inventory levels are not maintained. Otherwise, farm product inventory is maintained and field product allocations are only completed for those products that have been recorded as used in the period. If the usage is recorded to the farm, this task will allocate that cost to the stages on the farm in the period based on bird days. The allocation to the entity will occur in the farm to entity allocation task. If the field product was initially recorded to the entity, this task will record the allocation to the correct stage and no further transactions are recorded.

Calculate task.

Possible warning resulting from this task may be due to the fact that there are field products that have been used at the farm and there are no entities to allocate the product usage costs. If this warning is received, verify that the transactions was keyed to the correct farm. If correct, the amount will remain in the product inventory account until the next entity is placed at the farm.

Inventory usage can be reviewed for the period by generating report PE055 - 7600 B-BIM Field Product Allocation (Breeder Product Usage Summary). This report will display all usages to the farm and entity INV account for the period. Review report for accuracy. This report can be run at any time during the period.

After the allocation task has been run, generate the report 7600 B-BIM Field Product Allocation (Breeder Field Product Inventory Summary) for the end of the period. This report will display the amount remaining in inventory for the farm or entity. This should typically be zero unless the warning has been received that there are cost on a farm that cannot be allocated.

To view the costs allocated to the entity and stage for the period, generate PE056 - 7600 B-BIM Field Product Allocation (Entity Allocation by Stage). This report will display the amounts allocated to entities in the period.

Protein Cost Mode=Actual

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-INV-SUPPLIES-[ELEMENT]-OUT | Actual Cost | Not Set | Credits the actual field product cost from product inventory |

| Debit | BRDR-[STAGE]-SUPPLIES-[ELEMENT]-IN | Actual Cost | Not Set | Applies actual field product cost to entity stage |

Protein Cost Mode=Standard and Actual Cost (adjustment to actual w ill be recorded at movement transaction based on internal prices defined for the movement type)

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-INV-SUPPLIES-[ELEMENT]-OUT | Actual Cost | Not Set | Credits the actual field product cost from product inventory |

| Debit | BRDR-[STAGE]-SUPPLIES-[ELEMENT]-IN | Actual Cost | Not Set | Applies actual field product cost to entity stage |

The Farm to Entity task allocates any costs that have been recorded at the farm level to the stages and entities. For example, indirect costs for labor, utilities and maintenance may be directly recorded to the farm. This task will take those costs recorded to the farm using BRDR-OPS-[OBECT]-[ELELMENT]-[USER] and allocate the costs to the entities on the farm based on bird days. The method that these costs are allocated are dependent on the allocation type assigned to the specific account.

Non-Allocated – the cost is recorded on a specified date in the period. The expense will only be allocated to those entities that are active on the farm on that date. Any entity in the period that is not in existence on the transaction date will not be allocated any expense from a non-allocated account.

Allocated Daily – accounts with an allocation type specified as allocated daily will have those costs allocated to all entities in the period, regardless of the date that the transaction was entered.

Calculate the task.

Possible warning resulting from this task may be due to the fact that there are field products that have been used at the farm and there are no entities to allocate the operation or farm costs. If this warning is received, verify that the transactions were keyed to the correct farm. If correct, the amount will remain in the OPS account until the next entity is placed at the farm.

View the logs to review the data created by the task.

Generate report 7700 B-BIM Farm to Entity Allocation (Journal Balance Report). The amount on this report should be zero unless the warning message has been received where the amounts will be allocated to entities in subsequent months.

Generate report PE058 - 7700 B-BIM Farm to Entity Allocation (Entity Allocation by Stage) to view the amounts allocated to the entities.

The Farm to Entity Allocation task runs in two phases, therefore there is a log for each phase:

Farm OPS Allocation Log - allocates the OPS expenses to the stages at the farm in the period.

Farm to Entity Allocation Log - allocates the expenses from the farm to the entities in the period

Protein Cost Mode=Actual

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-OPS-[OBJECT]-[ELEMENT]-OUT | Actual Cost | Not Set | Credits the actual amount from the farm overhead account |

| Debit | BRDR-[STAGE]-[OBJECT]-[ELEMENT]-IN | Actual Cost | Not Set | Applies actual amount to entity stage |

Protein Cost Mode=Standard and Actual Cost (adjustment to actual will be recorded at movement transaction based on internal prices defined for the movement type. Farm to Entity will inherit the Standard Cost Type and Variance Type of the source transaction.)

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-OPS-[OBJECT]-[ELEMENT]-OUT | Actual Cost | Not Set | Credits the actual amount from the farm overhead account |

| Debit | BRDR-[STAGE]-[OBJECT]-[ELEMENT]-IN | Actual Cost | Not Set | Applies actual amount to entity stage |

BIM Movements calculate the cost of the transfer for brood to lay, or for multi-stage operations, from brood to grow. There is a task for each generation. If the transfer is brood to grow, the stage will change from brood to grow. In the transfer from brood to lay, the process credits each brood account for the source entity and debits the brood account for the destination entity. The stage at the destination will remain as brood until the entity is capitalized. If the transfer is brood to grow, the task will credit each brood account for the source entity and debit the grow account for the destination entity.

If Protein Cost Mode is set to Standard with Actual Cost or Standard Cost with Variance, the movements task will transfer values based on the rates entered in internal prices for the selected movement type. Differences between actual and standard will be recorded to either an adjustment account or a variance account depending on the mode.

Calculate the task.

Right-click and select Movements Log to view the details created by the task. To view the costs for a movement line, double-click on the detail line and the BIM Movement Costs will be displayed. This tab displays the prior period costs, current period costs and costs moved. The details will also indicate if the cost is Allocated Daily or Non-Allocated.

Generate report PE028 - 10300 B-BIM Movements Brood Parent (Brood Movement Summary) to view the entities that were moved in the period.

Generate report PE027 - 10300 B-BIM Movements Brood Parent (Breeder Brood Transfer Out Summary) to view the entities moved out by account.

The following log is generated when the period end task is run. Click on the task and right-click to select the log:

Protein Cost Mode=Actual

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-BROOD-[OBJECT]-[ELEMENT]-OUT | Actual Cost | Not Set | Credits the source entity for the actual amount |

| Debit | BRDR-BROOD-[OBJECT]-[ELEMENT]-IN | Actual Cost | Not Set | Debits the destination entity for the actual amount |

Protein Cost Mode=Standard and Actual Cost (adjustment to actual will be recorded based on internal prices defined for the movement type.)

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

Debit/Credit |

BRDR-BROOD-[OBJECT]-[ELEMENT]-OUT | Price Variance* | Breeder Prod* | Records the adjustment from standard to actual to the source entity account |

| Debit/Credit | BRDR-BROOD-[OBJECT]-[ELEMENT]-IN | Price Variance* | Breeder Prod* | Records the adjustment from standard to actual to the destination entity account |

| * Depending on how the standards are entered, the Standard Cost Type can be Performance Variance (standard to standard) or Price Variance (Standard to Actual). Variance Type will flow from source transactions except for variances incurred in the breeder production process. | ||||

The capitalization task is based on the capitalizations transactions that are entered for the period. The process moves the entity costs from the brood or grow stage to the capitalization account.

Calculate task.

Right-click and view the details for the entities capitalized in the period. To view the details of the amounts capitalized, click on the required capitalization line and double click to display 'BIM Capitalization Costs'. This will display the amounts transferred to capitalization by account.

The details can also be viewed in PE031 - B-BIM Capitalization (Period End Capitalization)>Capitalization Detail. Generate the report and click on the '+' to view the amounts capitalized by account.

A summary of the capitalized entities can be viewed in PE031 - B-BIM Capitalization (Period End Capitalization)>Capitalization Summary.

PE030 - B-BIM Capitalization (Breeder Capitalized Summary) and PE029 - B-BIM Capitalization Summary (Breeder Brood Summary by Account) display the details based on journal transactions if verification is required.

Once the details are finalized, PE023 - Period End Breeder Brood Inventory can be generated which represents the period end brood inventory value by entity. This is considered the audit report to the brood inventory for the period.

If Protein Cost Mode is set to Standard with Actual Cost or Standard Cost with Variance, the capitalization task will transfer values based on the rates entered in internal prices for capitalization transactions. Differences between actual and standard will be recorded to either an adjustment account or a variance account depending on the mode.

Protein Cost Mode=Actual

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-BROOD-[OBJECT]-[ELEMENT]-OUT | Actual Cost | Not Set | Credits the brood entity for the actual amount |

| Debit | BRDR-CAPHEN-INV-BRDRFEMALE-IN | Actual Cost | Not Set | Debits the capitalization account for the total capitalized cost |

Protein Cost Mode=Standard and Actual Cost (adjustment to actual will be recorded based on internal prices defined for capitalization)

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

Debit/Credit |

BRDR-BROOD-[OBJECT]-[ELEMENT]-OUT | Price Variance* | Breeder Production* | Records the standard to actual adjustment amount from the brood entity account |

Debit/Credit |

BRDR-BROOD-[OBJECT]-[ELEMENT]-OUT | Production Variance* | Breeder Production* | Records the standard to standard adjustment amount from the brood entity account |

| Debit/Credit | BRDR-CAPHEN-INV-BRDRFEMALE-IN | Price Variance* | Breeder Production* | Records the standard to actual adjustment amount to the capitalization account |

| Debit/Credit | BRDR-CAPHEN-INV-BRDRFEMALE-IN | Production Variance* | Breeder Production* | Records the standard to standard adjustment amount to the capitalization account |

| * Depending on how the standards are entered, the Standard Cost Type can be Performance Variance (standard to standard) or Price Variance (Standard to Actual). Variance Type will flow from source transactions except for variances incurred in the breeder production process. | ||||

The depreciation task calculates the depreciation cost for the period. There is a task for each generation and depreciation method. The process will credit accumulated depreciation for the period and debit the depreciation expense for the entity.

Straight Line

Percentage

HE/HH

Calculate the required depreciation task.

Right-click and select Depreciation Log. The log displays the details for the calculation for depreciation for each entity. The details can also be viewed in the report PE033 - 10500 B-BIM Depreciation Straight Line (Depreciation Summary). Reports for other depreciation modes can be run as they become available in the system.

Generate PE032 - 10500 B-BIM Depreciation (Breeder Depreciation Summary) to view the summary of the journals recorded for depreciation. This should match the depreciation log.

Protein Cost Mode=Actual

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-CAPHEN-ACMDEPR-BRDRFEMALE-OUT | Actual Cost | Not Set | Credits the accumulated depreciation account for the depreciation expense |

| Debit | BRDR-LAY-DEPR-00000-IN | Actual Cost | Not Set | Debits the depreciation expense for the entity |

Protein Cost Mode=Standard and Actual Cost

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-CAPHEN-ACMDEPR-BRDRFEMALE-OUT | Standard Cost | Not Set | Credits the accumulated depreciation account for the standard depreciation expense |

Debit/Credit |

BRDR-CAPHEN-ACMDEPR-BRDRFEMALE-OUT | Price Variance | Breeder Prod | Records the standard to actual adjustment amount for the depreciation expense |

Debit/Credit |

BRDR-CAPHEN-ACMDEPR-BRDRFEMALE-OUT | Production Variance | Breeder Prod | Records the standard to standard adjustment amount for the depreciation expense |

| Debit | BRDR-LAY-DEPR-00000-IN | Standard Cost | Not Set | Debits the standard amount to the depreciation expense account |

| Debit/Credit | BRDR-LAY-DEPR-00000-IN | Price Variance | Breeder Prod | Records the standard to actual adjustment amount for the depreciation expense |

| Debit/Credit | BRDR-LAY-DEPR-00000-IN | Production Variance | Breeder Prod | Records the standard to standard adjustment amount for the depreciation expense |

The Lay Movements task calculates the gain or loss on spent breeders transferred to an internal plant or sold to an external plant. The cost that is transferred is based on the salvage value defined in the depreciation method. The task will credit the capitalization cost and debit accumulated depreciation. On the final transfer from the farm to the plant or customer, the system will calculate the gain or loss on the entity to set the net book value to zero. The account for the calculated gain/loss is determined by the account defined in Poultry>Broiler Breeder>Period End>End of Lay Variance Mode.

If Protein Cost Mode is set to Standard with Actual Cost or Standard Cost with Variance, the movements task will transfer values based on the rates entered in internal prices for the selected movement type. Differences between actual and standard will be recorded to either an adjustment account or a variance account depending on the mode.

Calculate task.

Right-click and select Movements Log to view the details created by the task. To view the costs for a movement line, double-click on the detail line and the BIM Movement Costs will be displayed. This tab displays the prior period costs, current period costs and costs moved. The details will also indicate if the cost is Allocated Daily or Non-Allocated. To view a summary of the details, generate report PE036 - B-BIM Movements Lay (Lay Movement Summary).

To view the details for farm to plant transfers, generate report PE035 - B-BIM Movements Lay (Farm to Plant Summary). This report will display the amounts removed from the capitalization accounts and the gain/loss recorded for each entity.

To view the details for lay farm to farm transfers, generate report PE034 - B-BIM Movements Lay (Farm to Farm Summary)>Breeder Farm to Farm Transfer In or PE034 - B-BIM Movements Lay (Farm to Farm Summary)>Breeder Farm to Farm Transfer Out.

Once this task is complete and reconciled, generate PE047 - Period End Capitalization Inventory. This report provides a summary of the capitalized inventory at the end of the period that can be used for audit purposes.

Protein Cost Mode=Actual

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDR-CAPHEN-INV-BRDRFEMALE-OUT | Actual Cost | Not Set | Credits the capitalization cost for the total capitalized cost of the entity |

| Debit | BRDR-CAPHEN-ACMDEPR-BRDRFEMALE-OUT | Actual Cost | Not Set | Debits the accumulated depreciation account to the total depreciation of the entity |

| Debit/Credit | [LOC]-[STAGE]-GAINLOSS-BRDRFEMALE-IN | Actual Cost | Not Set | Records the gain/loss to the account defined in End of Lay Variance Mode |

Protein Cost Mode=Standard and Actual Cost (adjustment to actual will be recorded based on internal prices defined for the movement type. All standard costs are recorded in the Standard Journals, therefore movements only records the variances)

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

Debit/Credit |

BRDR-CAPHEN-INV-BRDRFEMALE-OUT | Price Variance | Breeder Production | Records the standard to actual adjustment amount capitalized for the entity |

Debit/Credit |

BRDR-CAPHEN-INV-BRDRFEMALE-OUT | Production Variance | Breeder Production | Rec (ords the standard to standard adjustment amount capitalized for the entity |

| Debit/Credit | BRDR-CAPHEN-ACMDEPR-BRDRFEMALE-OUT | Price Variance | Breeder Production | Records the standard to actual adjustment for the accumulated depreciation for the entity |

| Debit/Credit | BRDR-CAPHEN-ACMDEPR-BRDRFEMALE-OUT | Production Variance | Breeder Production | Records the standard to standard adjustment for the accumulated depreciation for the entity |

| Debit/Credit | [LOC]-[STAGE]-GAINLOSS-BRDRFEMALE-IN | Price Variance | Breeder Production | Records the standard to actual adjustment gain/loss to the account defined in End of Lay Variance Mode |

| Debit/Credit | [LOC]-[STAGE]-GAINLOSS-BRDRFEMALE-IN | Production Variance | Breeder Production | Records the standard to standard adjustment gain/loss to the account defined in End of Lay Variance Mode |

If the option in Registry>Poultry>BroilerBreeder>Spike Male Cost Mode is set to Expense Spiking Male Costs, this task is used to allocate the spiking costs to BRDR-LAY. The Costs are allocated by hen days based on the cost center relationship as defined in BIM Spike Male Mapping. .

Protein Cost Mode=Actual

| Trans Code | Account | Standard Cost Type | Variance Type | Comments |

| Credit | BRDRM-BROOD-INV-BRDRMALE-OUT | Actual Cost | Not Set | Credits the spike male farm for the period costs |

| Debit | BRDR-LAY-OVHD-BRDRMALE-IN | Actual Cost | Not Set | Debits the lay entity for the spike costs allocated |