ingredients receivings

Ingredient receiving can be either created from the screen or manually entered in the Ingredient

Receiving screen. Receiving transactions record the ingredient in inventory

at the received cost as defined in the purchase order. Journal transactions

are recorded at receiving to record the charge to inventory/expense and

the offset to accounts payable accrual.

Prior to creating a Planned Ingredient Receiving, the following items

must be created:

The following procedures are outlined related to creating an Ingredient

Receiving:

Create

an Ingredient Receiving

- In FMTS>FMIM>Transactions>Ingredients,

select Receivings.

- In the Ingredients Receivings main index,

select

to create a new record.

to create a new record.

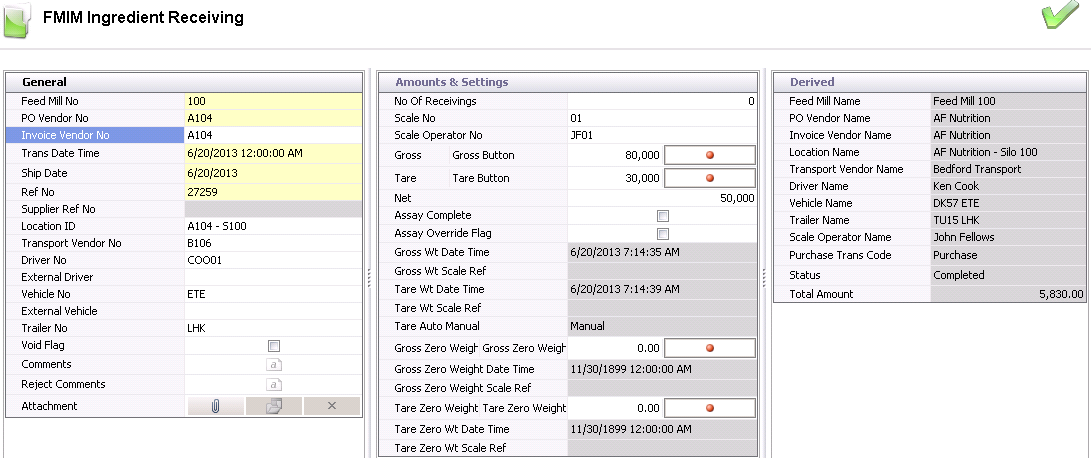

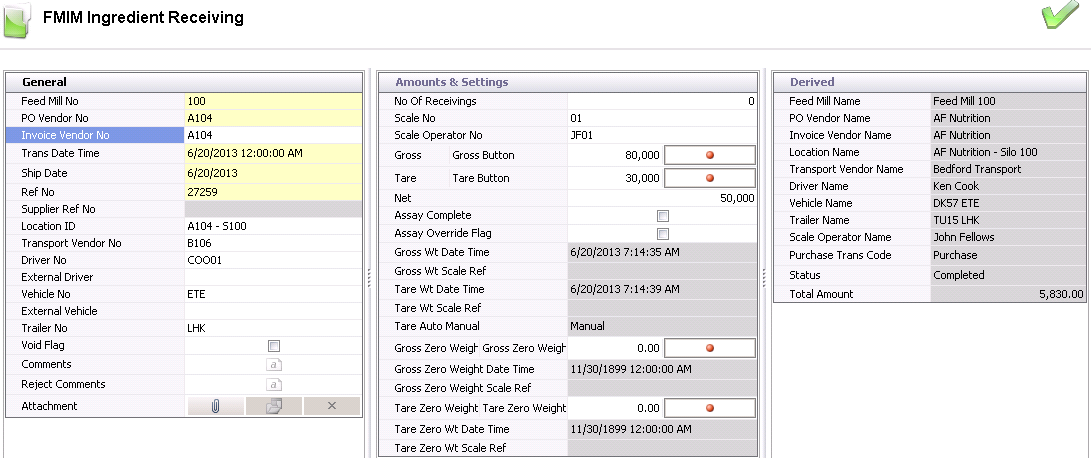

Ingredient Receiving Header

The Header section contains three sections:

General

Select the Feed

Mill No that identifies the feed mill that is receiving the

ingredients.

- Select the Vendor

No that indicates the vendor that is supplying the ingredients.

- Invoice Vendor

No will default based on the selected Vendor No. This field

is only modified if the non-receiving vendor logic is used. When the

purchase invoice is processed, the available receiving transactions

will be filtered based on the selected Vendor No and Invoice Vendor

No. Click to review the non-receiving vendor

logic.

- In the Trans

Date Time field, enter the date and time that the ingredients

were received.

- Enter the Ship

Date to indicate the date that the ingredient was shipped

from the vendor.

- Ref No

is an automatically-generated reference number that uniquely identifies

the receiving transaction.

- Supplier Ref

No is an optional field that is used to transfer the supplier

reference from the purchase order.

- Location ID

indicates the location from which the vendor shipped the ingredients.

Location ID is set up in:

- Transport Vendor

No displays the vendor that hauled the goods if the purchase

order excluded or delayed freight.

- Driver No

is an optional field to identify the internal driver delivering the

ingredients. The driver codes must be set up prior in: .

- External Driver

is an optional text field to identify the external driver delivering

the ingredients.

- Vehicle No

is an optional field to identify the internal vehicle that is delivering

the load. Vehicle codes must be set up prior in: .

- External Vehicle

is an optional text field to identify the external vehicle that is

delivering the load.

- Trailer No

is an optional field to identify the internal trailer that is delivering

the load. Trailers must be set up prior in: .

- Selecting the Void

Flag will delete the transaction and all corresponding journal

transactions.

- In the Comments

field, enter any additional details related to the receiving transaction.

- In the Reject

Comments field, indicate the reason that the load was rejected,

if applicable.

Amounts

and Settings

- Enter the No

of Receivings to indicate the number of receipts for the receiving

transaction. A default of ‘0’ indicates a single receiving transaction.

- Select the Scale

No that is reading the weights. This must be set up prior to

creating receiving transaction in: .

- From Scale

Operator No, select the scale operator number.

Scale operators must be set up prior to creating the receiving

transaction in: .

- In the Gross

field, enter the gross weight of the vehicle. This field can be manually

read or interfaced from a scale.

- In the Tare

field, enter the tare weight of the vehicle. This field can be manually

entered or interfaced from a scale.

- Net is

the difference between gross and tare. This field can be manually

entered or if weights are entered, it is calculated automatically.

- Assay Complete

is not selected by default, and is used in conjunction with the Planned

Receiving screen. When testing of the assays is required, the

'Assay Complete' box is selected. This will turn the calendar

option to blue to let the user know the status that the truck is in

the yard awaiting assay testing.

- Selecting the Assay

Override Flag will allow the user to receive the ingredient

even if the assays are outside of the tolerance levels.

- Gross Wt Date

Time displays the date and time that the gross weight was recorded

at the scale.

- Gross Wt Scale

Ref No displays the reference number for the gross weight scale

reading.

- Tare Wt Date

Time displays the date and time that the tare weight was recorded

at the scale.

- Tare Wt Scale

Ref No displays the reference number for the tare weight scale

reading.

- Tare Auto Manual

indicates the tare setting of Auto or Manual.

- Gross Zero Weight

Button is used if a zero weight

is required.

- Gross Zero Weight

Date Time indicates date and time that zero weight was recorded.

- Gross Zero Weight

Scale Ref is a reference number generated from the scale for

the zero weight.

- Tare Zero Weight

Button is used if a zero weight is required.

- Tare Zero Wt

Date Time indicates date and time that zero weight was recorded.

- Tare Zero Wt

Scale Ref is a reference number generated from the scale for

the zero weight.

Derived

The information in the Derived fields automatically generates from the

first two grids - General and Amounts and Settings. The fields are read-only

and cannot be modified.

- Feed Mill Name

is derived from the selected feed mill.

- Vendor Name

represents the vendor that is shipping the ingredients.

- Location Name

is assigned to the vendor and indicates the name of the location that

the ingredient is being shipped from.

- Transport Vendor

Name is the derived name of the haulage vendor selected for

the transaction.

- Driver Name

represents the internal driver that is delivering the ingredients.

- Vehicle Name

defines the internal vehicle that is delivering the ingredients.

- Trailer Name

indicates the trailer that is transporting the ingredients.

- Scale Operator

Name represents the name of the individual that was responsible

for entering the scale data.

- Purchase Trans

Code for receiving transactions will always be defined as Purchase.

- Status

represents where the transaction is in the receiving process. The

status drives the color coding in the

screen.

Total Amount

represents the total amount of the transaction including product,

add-ons, freight and taxes.

Receiving

Line Details

The line details relate to the product that is being received from the

vendor. In the child grid for the line item are the details related to

add-ons and assays. These amounts will default as defined from the purchase

order and cannot be modified at receiving. If there is freight assigned

to the product, there will be two lines appear in the lines details for

each product received. The first line will be related to the product details

and amount with the second line referencing the freight amounts.

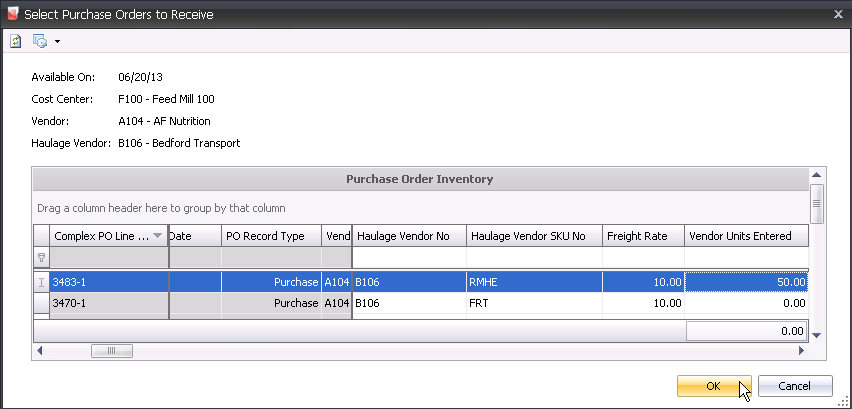

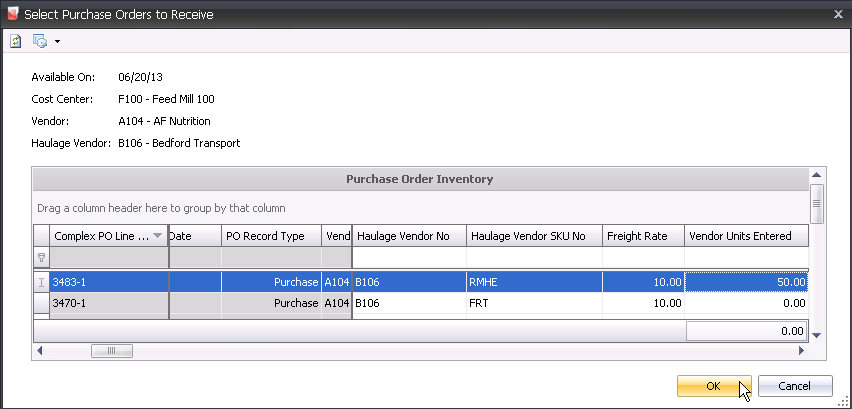

- Click on the Details

grid.

- Select

to create a new PO Inventory screen.

to create a new PO Inventory screen.

- Select the appropriate PO line.

- In the Vendor

Unit Entered field, enter the number of inventory units for

the receiving transaction. There is a registry switch option - Product Type>Receiving Units Mode

- that determines if the products are received by vendor units

or inventory units.

- If the purchase order has the freight type set

to Delayed,

Haulage Vendor No , Haulage Vendor SKU No and Freight Rate can be modified if

required in the selection grid.

- Click the OK button to create the line details.

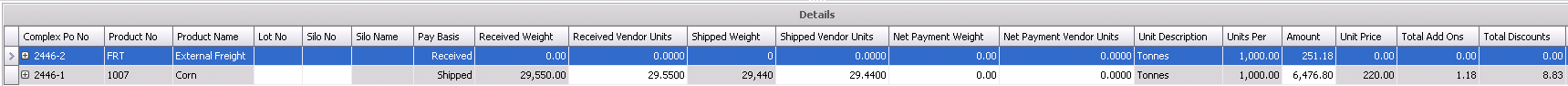

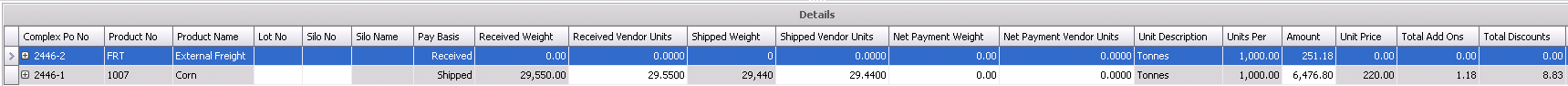

- The Details tab contains the base information

relating to the products being received from the vendor. There are

several fields on the receiving transaction which will be displayed

in multiple sections for this part of the document.

- Complex Po No

indicates the purchase order that is being received. Purchase orders

must be in 'Posted' status. Purchase orders will be filtered based

on the cost center and vendor selected in the header.

- In the Product

No field, enter the product number that is being received on

the purchase order.

- Product Name

defaults from product No and displays the name of the product being

purchased.

- Lot No

is an optional field to record the lot number for the ingredient being

received. The lot number will follow the ingredient through to the

production process. Costs will remain with the defined lot.

- Silo No

is an optional field to record the silo location from which the product

is being received. Costs will remain with the defined silo.

- Silo Name

defaults from Silo Name and displays a description of the selected

silo.

- Pay Basis

defaults from the purchase order and indicates if the payment to the

vendor is being determined based on the received weight, shipped weight

or net payment weight.

- Received Weight indicates

the weight that is being received. This amount will default from the

net weight in the contract header. Depending on a setup switch that

determines whether the receiving transactions are recorded based on

inventory units or vendor units, this field may be automatically calculated.

- Received Vendor

Units indicates the number of vendor units that are being

received. For example, the received weight is in pounds, but the product

was purchased from the vendor in tons. Depending on a setup switch

that determines whether the receiving transactions are recorded based

on inventory units or vendor units, this field may be automatically

calculated.

- Shipped Weight

is an optional field to enter the shipped weight if the vendor is

being paid based on shipped weight. Depending on a setup switch that

determines whether the receiving transactions are recorded based on

inventory units or vendor units, this field may be automatically calculated.

- Shipped Vendor

Units is an optional field to enter the shipped vendor units

if the vendor is being paid based on shipped weight. Depending on

a setup switch that determines whether the receiving transactions

are recorded based on inventory units or vendor units, this field

may be automatically calculated.

- Net Payment Weight

is a calculated field that is used when the assay result modifies

the weight that the vendor will be paid for the product. In the assay

definition in or Ingredient

Versions, the Scan Comparison value is set to Weight Adjustment.

- Net Payment Units

is a calculated field the will be calculated then Net Payment Weight

option is used. The units will be based on the weight adjusted and

in inventory units for each vendor unit.

- Unit Description

is derived from Vendor Sku and displays the unit of measure from which

the product was purchased from the vendor.

- Units Per is

derived from Vendor Sku and indicates the number of units in

each vendor unit.

- The Unit Price

defaults from the PO with no option to modify at receiving.

- Amount

is a calculated field for the Received/Shipped/Net Payment Vendor

Units x Unit Price.

- Total Add-ons

is a calculated total amount of premium add-ons that will be added

to the vendor payment based on the amounts defined in the purchase

order. Details are located in child grid.

- Total Discounts

is a calculated total amount of discount add-ons that will be deducted

from the vendor payment based on the amounts defined in the purchase

order. Details are located in child grid.

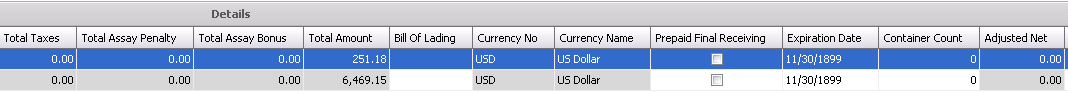

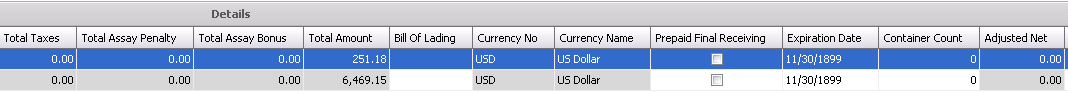

- Total Taxes

is a calculated amount based on the taxable product and/or add-ons

as defined in the purchase order. Details are located in the child

grid.

- Total Assay Penalty

is a calculated amount that will be deducted from the vendor payment

based on the configuration of the assays. Details are located in the

child grid.

- Total Assay Bonus

is a calculated amount that will be added to the vendor payment based

on the configuration of the assays. Details are located in the child

grid.

- Total Amount

is a calculated total amount of the receiving transaction based on

the amounts that are defined in the purchase order.

- Bill of Lading

is a location to enter the bill of lading reference for the receiving

line.

- Currency No

is derived from the purchased order.

- Currency Name

is derived from the Currency No.

- Prepaid Final

Receiving check box will be checked if the receiving is the

final receiving. This option is only required if the prepaid purchase

order will have multiple receipts. By selecting this option, the journal

transaction will clear out the remaining accrual and book any incurred

differences to the purchase price variance account.

- Expiration Date

can be used to enter the expiration date of the product.

- Container Count

can be used to enter the number of containers required.

- Adjusted Net

Additional

Line Details

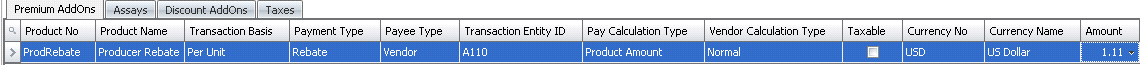

Within the Complex Po No field, there is a child grid containing additional

details relating to the ingredients receiving.

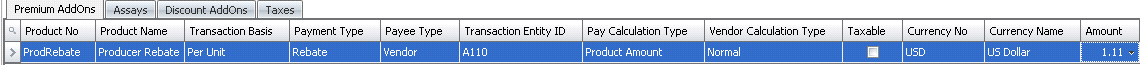

Premium and discount add-ons default from the purchase order. Amounts

will be calculated based on the amount received.

- Product No

displays the code of the selected add-on.

Product Name displays a description

of the add-on.

Transaction Basis is a read-only

field that defaults from the selected add-on and determines how the

add-on is calculated on orders. Options are: Per Unit, Percentage,

Flat Rate, or Free Percentage.

Payment

TypeTransaction:

Processed with the sales invoice.

Rebate: Processed at a date later than the invoice..

Internal: An internal transaction is a transaction that is not invoiced

to an external source (Example: There is an internal haulage

department that gets a credit for hauling products).

is a read-only field that derives from the purchase order and determines

when the add-on payment is made.

Payee Type is an optional field

that indicates the source type for the premium or discount add-on.

Transaction

Entity ID is a required field if a different Payee Type is

selected. If Payee Type is set, the selected vendor or cost

center name will appear in this field.

Pay Calculation

Type defaults from the vendor sku and determines the base amount

of the add-on calculation.

Product

Amount - the add-on is calculated based on only the product

amount and does not include any other add-on in the calculation

of the amount.

Net

Amount - the add-ons is calculated based on the net amount

of the transaction based on the product amount including other

add-on amounts, but excluding taxes.

- Vendor Calculation

Type determines if the payment is calculated based on

the base add-on logic using Transaction basis or if the add-on amount

is only deducted from the vendor payment.

Normal

- the add-on is calculated based on the rules established

by Transaction Basis and the Payment Type defined in the vendor

SKU and sales SKU.

Deduction

Only - the add-on is calculated based on the rules

established by Transaction Basis, however the add-on is only

deducted from the vendor payment.

Taxable identifies if the item is

taxable or non-taxable when the add-on is purchased. The flag will

be selected if the item is taxable.

Currency No defaults based on the

currency assigned to the purchase order as defined, with no option

to modify.

Currency Name displays a description

of the currency type.

Amount displays the total cost of

the add-on.

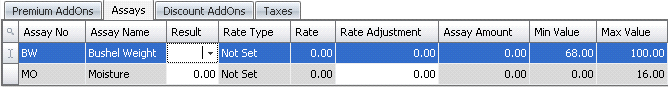

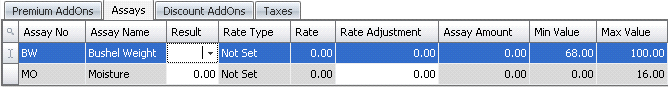

Product Assurance relates to the assays that are assigned in the purchase

order. There is the option to define penalty and bonus calculations so

that the vendors are penalized or rewarded based on the quality of the

product being received.

- Assay No

identifies the assay.

- Assay Name

displays a description of the assay.

- Result displays the assay rate.

- Rate Type indicates the source type

for the rate.

- Rate displays the assay rate.

- Rate Adjustment is used to enter

any adjustment for the rate.

- Assay Amount displays the total

amount of the assay.

- Min Value displays the minimum value

of the assay.

- Max Value displays the maximum value

of the assay.

Tax codes as defined on the purchase order will default to the receiving

transaction. The amount will be calculated based on the rate that is in

effect on the receiving date. There are two types of taxes.

- Accrual Taxes:

Will record the tax accrual and record the journal transaction at

time of receipt.

- Invoice Taxes:

Will calculate the tax at time of receipt, however the journal transaction

is not created until the purchase invoice is processed. Invoice taxes

are generally used for federal taxes that are reimbursed to the company

by the government and cannot be actually recorded until the vendor

invoice is received.

- Tax No

identifies the tax code.

- Tax Name

displays a description of the tax code.

- Amount

displays the total amount of taxes.

Post a Receiving Transaction

Once the receiving transaction has been created and saved, the transaction

needs to be posted. The posting process completes the following:

- Records the product to inventory

- Locks the receiving transaction record

- Creates the journal transaction to record

the accruals and amounts to the required accounts.

The UnPost option unlocks the receiving transaction and reverses the

journal transactions created at post. Once the receiving transaction has

been posted, the can be processed to

pay the vendor.

- In the Ingredient Receiving Transaction index,

select the required transfer transaction and right-click to select

'Post'. Alternatively, click the green check mark

in the top menu bar and select 'Post'.

in the top menu bar and select 'Post'.

- To un-post a receiving, select the required receiving

transaction and right-click to select 'UnPost' or select Options>UnPost.

This process will set the transaction status to Reversed which allows

the transaction to be edited. The unposting process will also reverse

the journal transaction created in the post process.

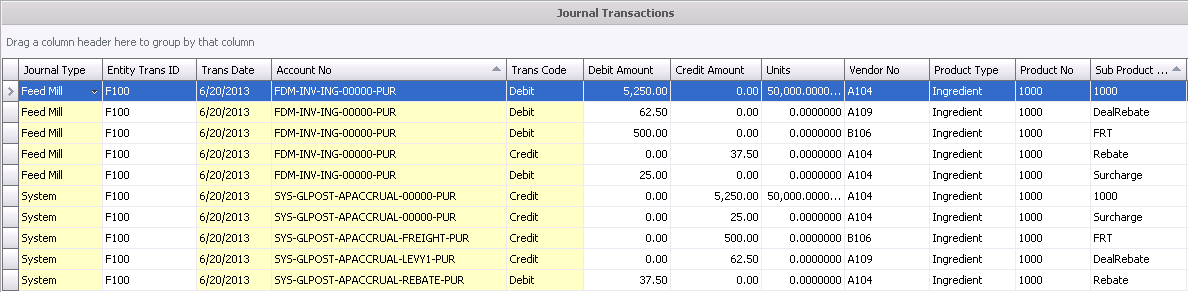

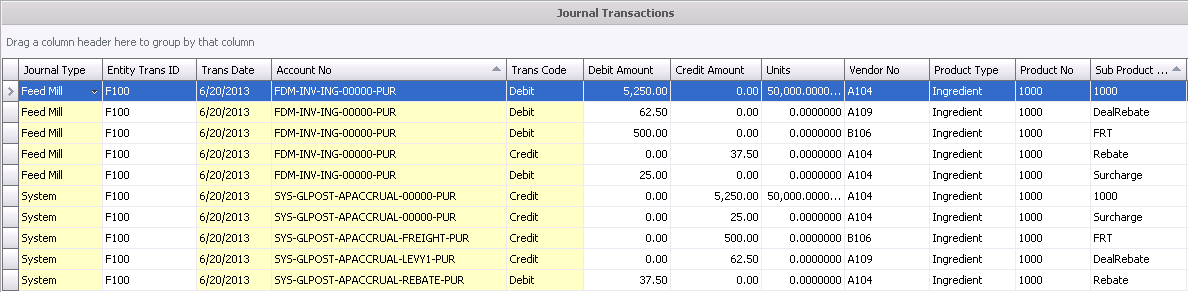

Journal

Transaction

The posting process creates the journal transaction. The journal will

record the product to inventory and create the accounts payable accrual.

| DEBIT |

Ingredient

Inventory |

| CREDIT |

Accounts Payable Accrual |

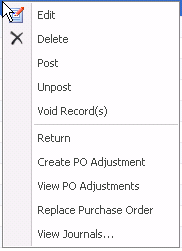

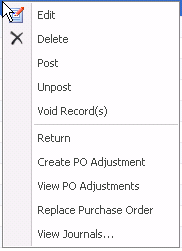

Right-Click

Options

While in the In the FMIM Ingredients Receiving index screen, more transaction

options are available by right-clicking on any line item. These options

are also available on the menu:

- Edit allows

changes to be made to the record before it is posted.

- Delete

removes the record completely from the system. Records

must be in 'Unposted' status first.

- Post locks

the record and the record becomes-read only.

- Unpost

unlocks the record so the record can be edited.

- Void Records

leaves the record in the system in 'voided' status, and also voids

the journal transaction so it is not included in the data. This options

is used when an audit trail is needed..

- Return

is used when the feed/ingredient was returned to the vendor.

- Create PO Adjustment

allows the adjustment of the outstanding amount on the purchase

order. This applies to debit or credit adjustments.

- View PO Adjustments

shows a summary of the adjustments that have been made to the PO for

the ingredient that is being received.

- Replace Purchase

Order is used if the purchase order has been

received to the wrong PO.

- Print Ingredient

Ticket prints the default system ingredient receiving ticket

as long as the report is mapped in Admin>System>Screen

Report Mappings. *Note:

This is not used in V 7.26 and upé

- Print Ingredient

Vehicle Auth. Doc prints the default system vehicle authorization

report if the report is mapped in Admin>System>Screen

Report Mappings. *Note:

This is not used in V 7.26 and upé

Create

an Ingredient Return

An Ingredient Return Transaction is created when the product is returned

to the vendor and the vendor will receive credit for the product that

is returned. The ingredient is returned from the original receiving transaction,

therefore all of the pricing details will default based on the purchase

order assigned to the receiving transaction. Once the ingredient return

is posted, the credit memo payable can be processed using Purchase

Invoices>Vendor Return.

- In the FMIM Ingredients Receiving index, right-click

on the required receiving record and select 'Return'.

- Enter the date of the return in the date prompt.

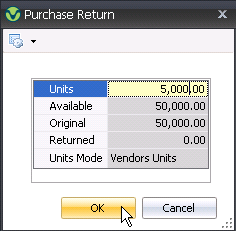

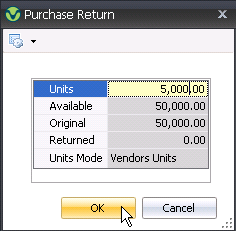

- The Purchase Return dialogue will appear.

- Enter the number of Units

that are being returned to the vendor. The maximum total amount returned

cannot exceed the original receiving transaction.

- Available

auto-populates, and is the amount of receiving units that are available

to be returned.

- Original

auto-populates, and is the number of original purchased units.

- Returned

auto populates with the units of previous returns for this record.

- The Units Mode

indicates whether the units are entered based on inventory units or

vendor units. This is determined by the Received Units Mode established

in the registry by product type.

- Click `OK` to create the vendor return.

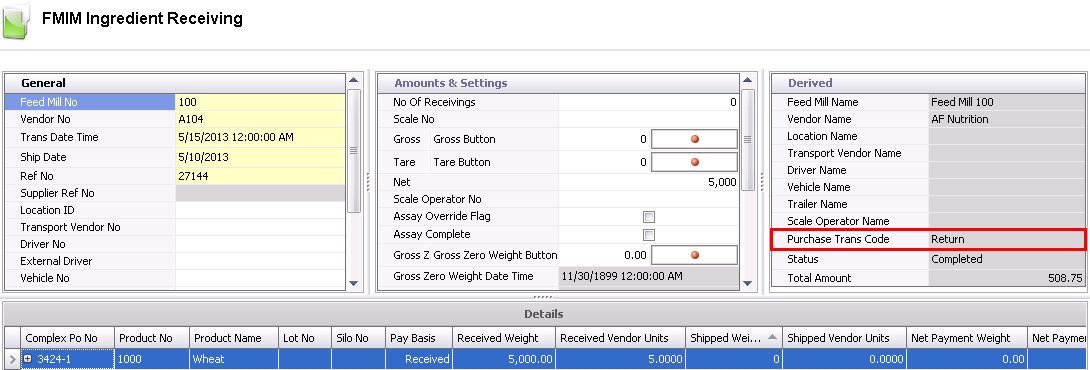

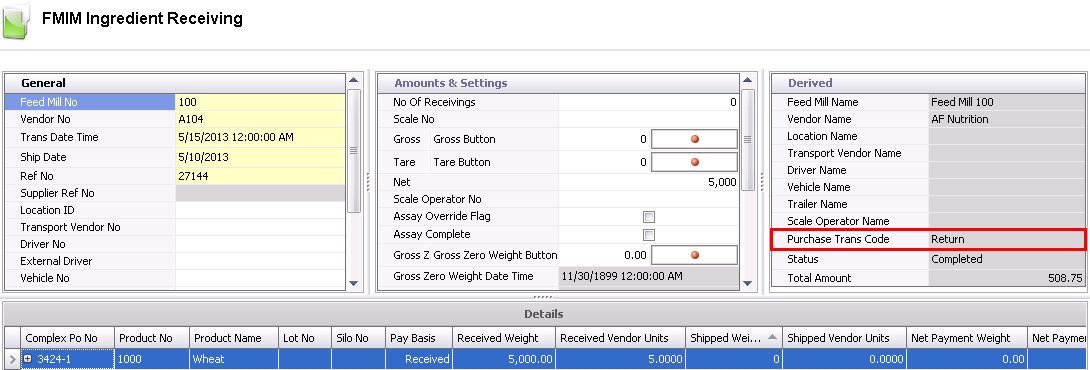

- The FMIM Ingredient Receiving screen will appear

with the returned weight and the pricing details, based on the purchase

order, defaulting into the screen.

- The Ref No will be set to the same reference number

as the original receiving transaction.

- The Purchase Trans Code will be set to Return

to indicate that the transaction is a return transaction.

- Save and close the transaction.

- Post record.

- Once the vendor return transaction has been posted,

the credit to the vendor can be completed using the Purchase

Invoices>Vendor Return Option.

Create

PO Adjustment

Create PO Adjustments will debit and credit the defined purchase orders

for a specified quantity. This option is usually completed done when the

ingredient has been received to the wrong PO. The PO Adjustment option

only affects quantities and does not modify the pricing on the original

receiving transaction. Receiving transactions must be in posted status

for a PO Adjustment to be created. If the quantities and amounts are to

be transferred from one purchase order to another, use the Replace

Purchase Order option.

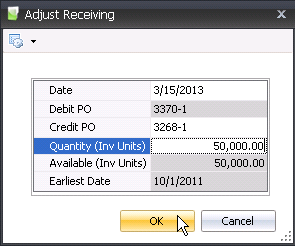

- In the FMIM Ingredients Receiving index, select

the receiving transaction for the purchase order that is required

to be adjusted and right-click to select Create PO Adjustment.

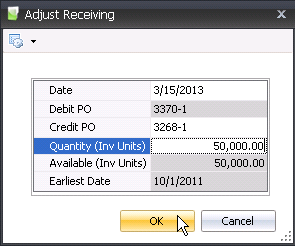

- Enter the Date

of the adjustment.

- The Debit PO

will auto-populate from the receiving transaction that is being adjusted.

- Select the Credit

PO to be adjusted.

- Enter the Quantity

(Inv Units) amount to be adjusted. This amount cannot

exceed the quantity received on the original receiving transaction,

nor can it exceed the inventory units of the Credit PO.

- Available (Inv

Units) is derived based on the following:

- If the Credit PO has a quantity inventory

that meets or exceeds the receiving transaction quantity, the

receiving quantity will be available.

- If the Credit PO has a quantity inventory

that is less than the receiving transaction quantity, the Credit

PO inventory + the purchase tolerance allowance will be available

for adjustment. For example, if the Credit PO inventory is 25,000

units and the ingredient version purchase tolerance is set to

5%, the Available units will be 26,250.

- Earliest Date

is the earliest date the adjustment can be made. This is derived from

the earliest receive date defined on the Credit PO.

- Click OK to adjust the purchase order quantities

for the amount defined on the dialogue. Not that the purchase order

on the receiving transaction does not get changed. It only moves the

quantity from one purchase order to another. The process will increase

the inventory for the Debit PO and decrease the available inventory

for the Credit PO.

- Adjustments can be viewed by right-clicking on

the receiving transaction and selection View

PO Adjustments or go to General>Purchases>Order

Adjustments to view the debit and credit adjustments.

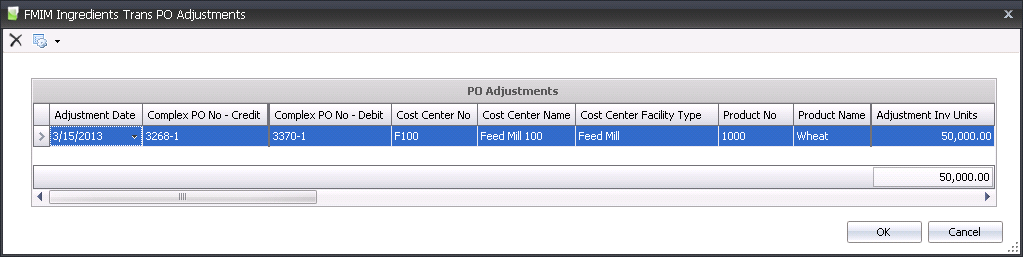

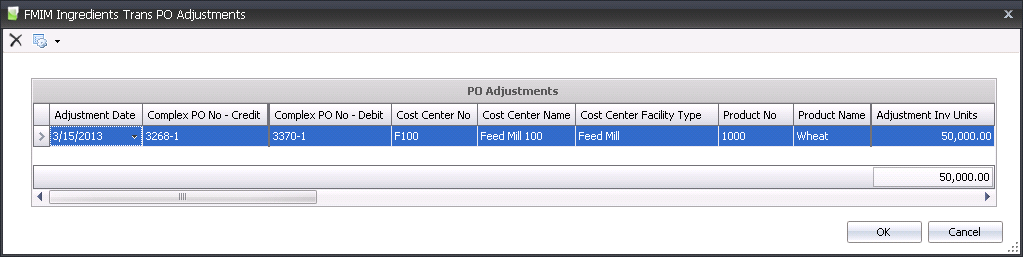

View PO Adjustments

The View PO Adjustments allows the user to view any purchase order adjustments

that have been made to the receiving transaction.

- In the Ingredients Receiving index, select the

required receiving transaction and right-click to select View PO Adjustments

- The Ingredient Trans PO Adjustments will be displayed

with any adjustments that have been made to the purchase order on

the receiving transaction.

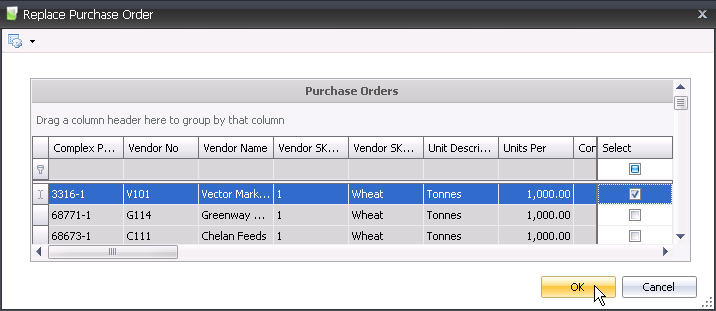

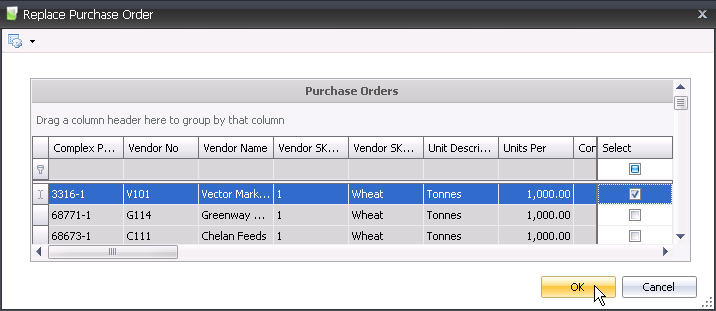

Replace

Purchase Order

If the purchase order has been received to the wrong PO, Replace Purchase

Order can be utilized to update quantities and amounts. From 'Replace

Purchase Order', a list of purchase orders for the same product can

be found in order to switch the PO. Replace Purchase Order will replace

the cost of the ingredients, where Create

PO Adjustment will only adjust the quantity of the ingredients.

Replace Purchase order cannot be used with a 'Posted' record.

- In the FMIM Ingredients Receiving index, highlight

the Active or Reversed record that needs to be replaced.

- Right-click and select Replace

Purchase Order.

- Select the PO that will replace the original PO

by checking the flag in the Select

column.

Click 'OK'.

The original PO will be placed back in PO inventory

to be used at a later date.

If Delayed Freight was used to create the PO,

the Haulage Selection will need to be entered.

Select/Change the Haulage

Vendor No, if applicable.

Select/Change Haulage

Vendor Sku No, if applicable.

Enter the Freight

Rate.

The original PO will be placed back in PO inventory

to be used at a later date.

![]()

to create a new record.

to create a new record.

to create a new PO Inventory screen.

to create a new PO Inventory screen.

in the top menu bar and select 'Post'.

in the top menu bar and select 'Post'.