The following procedures are outlined in the Farm Receiving document:

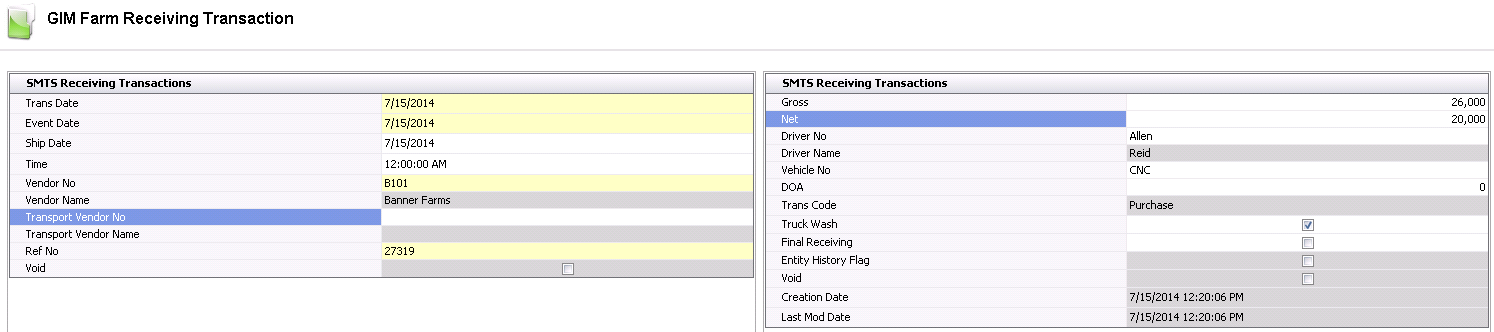

The farm receiving transaction consists of two sections. The header is used to enter the base data for the farm receiving transaction, while the Details default in from the selected receiving purchase order.

to create

a new farm receiving transaction.

to create

a new farm receiving transaction.

Ref No is a unique automatically-generated reference number that identifies the transaction.

Select the Void flag to reverse al transactions related to the receipt.

Enter the Gross weight of the vehicle.

Enter the Net weight of the product received.

Driver No is an optional field to select the driver that delivered the product. Drivers must be set up prior to use in: Admin>Business>General>Definitions>Drivers.

Driver Name will default in.

Vehicle No is an optional field to select the vehicle that delivered the product. Vehicles must be set up prior to use in: Admin>Business>General>Definitions>Vehicles.

In the DOA field, enter the number of animals that arrived dead on arrival (DOA).

Select the Truck Wash flag if the truck was washed upon leaving the farm.

Select the Final Receiving flag if this is the final receiving for the purchase order.

The Entity History flag will be selected if

The Void flag will default in from the flag in the first column.

Creation Date displays the date the transaction was created.

Last Mod Date displays the date the transaction was last modified.

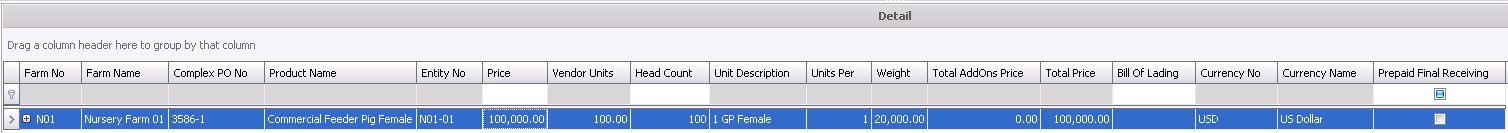

The Details will default in from information entered in the associated purchase order.

button.

button.

Currency Name displays a description of the currency type.

Select the Prepaid Final Receiving flag if the order was prepaid and this is the last delivery or receiving for the prepaid purchase order.

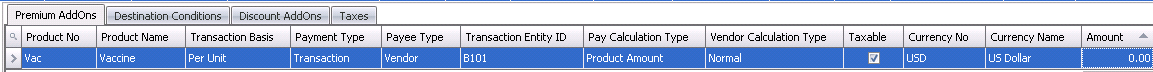

Within the Detail tab, there is a child grid with additional details relating to the receiving add-ons. The details will default from the purchase order.

The add-ons must be pre-defined in General>General>Products>AddOns prior to adding to the receiving transaction.

on the Farm No field to display the child grid.

on the Farm No field to display the child grid.

Product Name displays a description of the add-on.

Transaction Basis is a read-only field that defaults from the selected add-on and determines how the add-on is calculated on orders. Options are: Per Unit, Percentage, Flat Rate or Free Percentage.

Payment Type is a read-only field that derives from the purchase order and determines when the add-on payment is made.

Payee Type is an optional field that indicates the source type for the premium or discount add-on.

Transaction Entity ID is a required field if a different Payee Type is selected. If Payee Type is set, the selected vendor or cost center name will appear in this field.

Pay Calculation Type defaults from the vendor sku and determines the base amount of the add-on calculation.

Product Amount - the add-on is calculated based on only the product amount and does not include any other add-on in the calculation of the amount.

Net Amount - the add-ons is calculated based on the net amount of the transaction based on the product amount including other add-on amounts, but excluding taxes.

Normal - the add-on is calculated based on the rules established by Transaction Basis and the Payment Type defined in the vendor SKU and sales SKU.

Deduction Only - the add-on is calculated based on the rules established by Transaction Basis, however the add-on is only deducted from the vendor payment.

Taxable identifies if the item is taxable or non-taxable when the add-on is purchased. The flag will be selected if the item is taxable.

Currency No defaults based on the currency assigned to the purchase order as defined, with no option to modify.

Currency Name displays a description of the currency type.

Rate displays the total cost of the add-on.

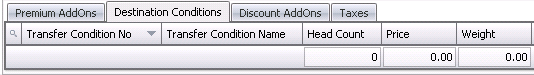

Based on a setup switch, the Destination Conditions tab may be required. If the option is selected, the Destination Conditions must be completed and balanced to the units and price for the line detail. The Destination Conditions are created in Admin>Business>SMTS>Definitions>Transfer Conditions.

If the product and/or premiums/discounts are taxable, the tax code must be assigned on the Taxes tab. The tax amount will then be calculated based on the taxable order amounts.

Tax No identifies the tax code to be applied to the product and premiums/discounts for the selected line item. The Taxable flag must be selected in the product and premiums/discounts for taxes to calculate.

Tax Name describes the selected tax code.

Amount is the total amount of tax applicable on the product.

Once the farm receiving transaction has been created and saved, the receiving needs to be posted. The posting process locks the farm receiving transaction to prevent edits, populates the entities' fields with data, and creates the journal transaction to record the liability. The UnPost option unlocks the receiving and reverses the journal transactions.

in

the top menu bar and select 'Post'.

in

the top menu bar and select 'Post'.

The posting process creates the journal transaction. When the receiving transaction is posted, the journal transaction is created to debit the delivery to the farm or entity and credit the accrued payable transaction. When the purchase invoice is posted, the journal transaction will debit the accrued payable transaction and credit the accounts payable.