ingredients consignment transfers

Consignment purchases occur when a vendor supplies goods to a customer,

however the vendor is not paid until the product is used. When the product

is received, the product is received to consignment inventory. The Consignment

Transfer moves the product from consignment inventory to ingredient inventory

so that the product can be used as required throughout the process. The

Consignment Transfer also creates the receiving transaction so that the

vendor can be paid for the amount used. The pricing details default from

the purchase order assigned to the consignment inventory. All prices and

add-ons will be transferred from the purchase order to the consignment

receiving transaction. Steps to create consignment inventory is outlined

in .

Prior to creating a Consignment Transfer, the following items must

be created:

The following procedures are outlined in the Consignment Transfer document:

Create

a Consignment Transfer

- In FMTS>FMIM>Transactions>Ingredients,

select Consignment Transfers.

- In the Ingredients Consignment Transfers

main index, select

to create a new consignment

transaction.

to create a new consignment

transaction.

- Click on the General

tab.

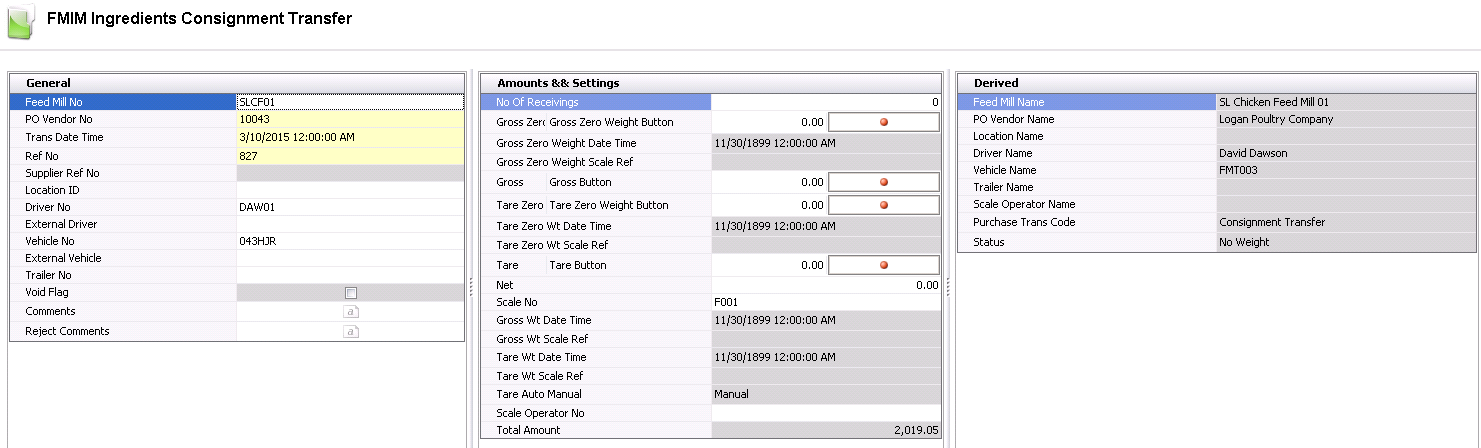

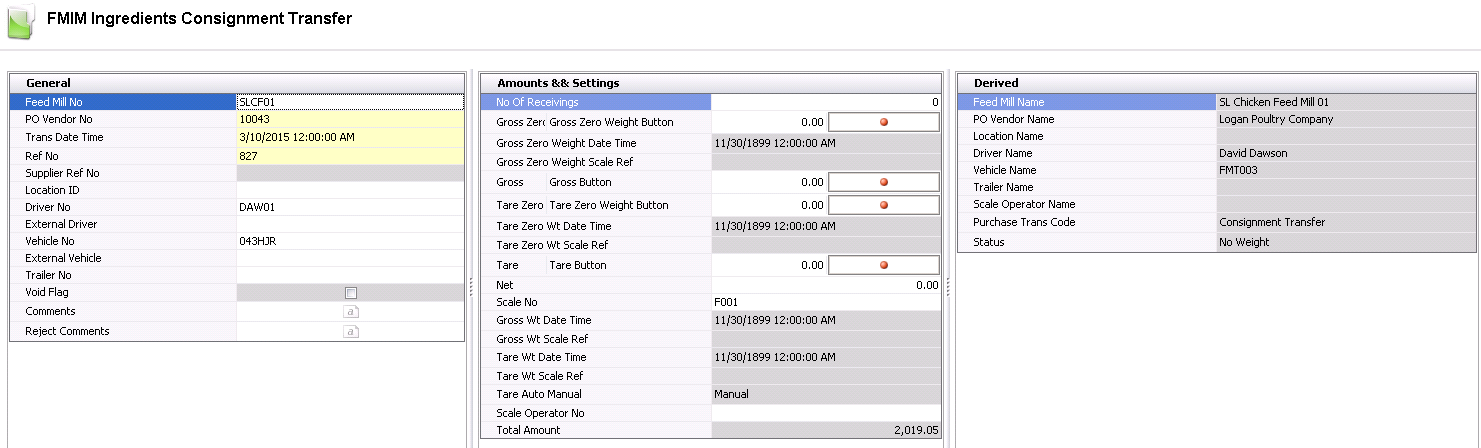

Consignment Transfer Header

The header section contains the following components:

General

From the Feed

Mill No drop-down menu, select the mill where the consignment

inventory is stored.

In the PO

Vendor No field, select the

vendor that holds the consignment inventory was received to the feed

mill

In the Trans

Date Time field, enter the date and time of the transfer.

- Ref No

is an automatically-generated reference number that uniquely identifies

the transfer transaction.

- Suppler Ref No

is auto populated from the Purchase Order.

- Location ID

is an optional field and is used to enter the location

of the detail vendor.

- Driver No

is an optional field used to identify the internal driver transferring

the ingredients. Drivers must be set up prior to use in: .

- External Driver

is an optional field used to identify the external driver transferring

the ingredients.

- Vehicle No

is an optional field used to identify the internal vehicle that is

transferring the load. Vehicles must be set up prior to use in: .

- External Vehicle

is an optional field used to identify the external vehicle that is

transferring the load.

- Trailer No

is an optional field used to identify the internal trailer that is

transferring the load. Trailers must be set up prior to use in: .

- Selecting the Void

Flag will delete the transaction and all corresponding

journal transactions.

- In the Comments

field, enter any additional details related to the transaction.

- In the Reject

Comments field, enter any addition details related to why the

product was rejected.

Amounts

& Settings

- Enter the No

of Receivings to indicate the number of receipts for the transfer

transaction. A default of ‘0’ indicates a single receiving transaction.

- Select the Scale

No that is reading the weights. This must be set up prior to

creating receiving transaction in: .

- From Scale Operator

No, select the scale operator number. Scale operators must

be set up prior to creating the receiving transaction in: .

- In the Gross

field, enter the gross weight of the vehicle. This field can be manually

read or interfaced from a scale.

- In the Tare

field, enter the tare weight of the vehicle. This field can be manually

entered or interfaced from a scale.

- Net is

the difference between gross and tare. This field can be manually

entered or if weights are entered, it is calculated automatically.

- Gross Wt Date

Time displays the date and time that the gross weight was recorded

at the scale.

- Gross Wt Scale

Ref No displays the reference number for the gross weight scale

reading.

- Tare Wt Date

Time displays the date and time that the tare weight was recorded

at the scale.

- Tare Wt Scale

Ref No displays the reference number for the tare weight scale

reading.

- Tare Auto Manual

indicates the tare setting of Auto or Manual.

- Gross Zero Weight

Button is used if a zero weight

is required.

- Gross Zero Weight

Date Time indicates date and time that zero weight was recorded.

- Gross Zero Weight

Scale Ref is a reference number generated from the scale for

the zero weight.

- Tare Zero Weight

Button is used if a zero weight is required.

- Tare Zero Wt

Date Time indicates date and time that zero weight was recorded.

- Tare Zero Wt

Scale Ref is a reference number generated from the scale for

the zero weight.

- Total Amount

is a calculated total amount of the receiving transaction based

on the amounts that are defined in the purchase order.

Derived

The information in the Derived fields automatically generates from the

first two grids - General and Amounts and Settings. The fields are read-only

and cannot be modified.

- Feed Mill Name

represents the feed mill where the consignment inventory is stored.

- Vendor Name

is derived from the Vendor No that supplied the product.

- Location Name

represents the name of the vendor location that sourced the product

based on the selected Location ID.

- Driver Name

indicates the name of the driver that transferred the goods if applicable.

- Vehicle Name

represents the name of the vehicle that transferred the goods if applicable.

- Trailer Name

defines the trailer that transferred the goods if applicable.

- Scale Operator

Name is derived based on the selected Scale Operator No.

- Purchase Trans

Code will always be defined as Consignment Transfer.

- Represents the Status

of the transaction. Status will be one of No Weight, In Progress or

Completed.

Consignment

Transfer Line Details

The line details relate to the product that is being received from the

vendor. In the child grid for the line item are the details related to

add-ons and assays. These amounts will default as defined from the purchase

order and cannot be modified at receiving. If there is freight assigned

to the product, there will be two lines appearing in the line details

for each product received. The first line will be related to the product

details and amount, with the second line referencing the freight amounts.

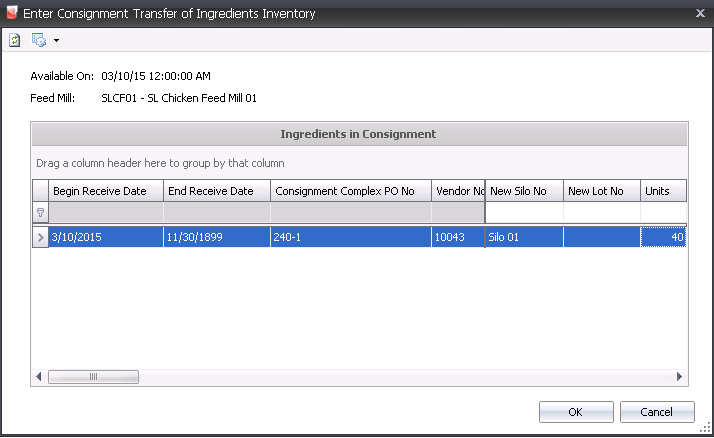

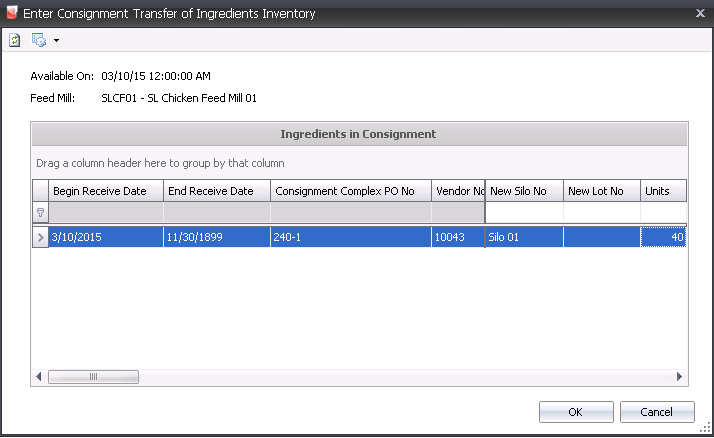

- Click on the Details

grid.

- Select

to

create a new Consignment PO Inventory screen.

to

create a new Consignment PO Inventory screen.

- Select the appropriate Consignment PO item and

enter the number of inventory Units

that are being transferred from consignment inventory to product inventory.

- Optionally, a New

Silo No can be selected, to identify the destination silo,

which may or may not be different than the source silo.

- Click the OK button to create the detail lines.

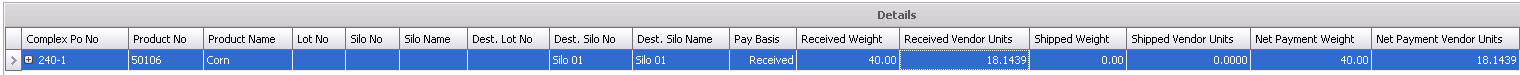

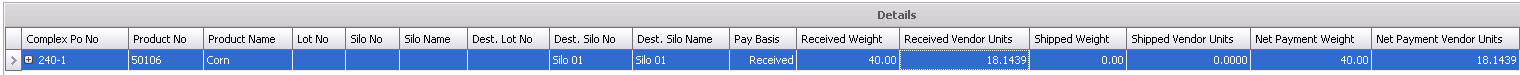

The Details tab will appear with the base information relating to

the purchase order.

- Complex Po No

indicates the consignment purchase order that is being transferred.

- The Product No

represents the ingredient that is being transferred from consignment

to product inventory.

- Product Name

defaults from Product No and displays the name of the product being

purchased.

- Lot No

is an optional field to record the lot number for the ingredient being

received. The lot number will follow the ingredient through to the

production process.

- Silo No

and Silo Name will default

in if the silo has been specified, to identify the silo location from

which the product is being received.

- Dest. Lot No

identifies the lot number for the destination where the ingredient

is being received.

- Dest. Silo No

indicates the destination silo number where the product is being received.

This will default in from the Silo No selected in the Consignment

PO Inventory screen.

- Dest. Silo Name

displays a description of the destination silo.

- Pay Basis

defaults from the purchase order and indicates if the payment to the

vendor is being determined based on the received weight or the shipped

weight. Consignment inventory is normally based on received units

or weight.

- Received Weight indicates

the weight that is being received. This amount will default from the

net weight in the contract header. Depending on a setup switch that

determines whether the receiving transactions are recorded based on

inventory units or vendor units, this field may be automatically calculated.

- Received Vendor

Units indicates the number of vendor units that are being

received. For example, the received weight is in pounds, but the product

was purchased from the vendor in tons. Depending on a setup switch

that determines whether the receiving transactions are recorded based

on inventory units or vendor units, this field may be automatically

calculated.

- Shipped Weight

is an optional field to enter the shipped weight if the vendor is

being paid based on shipped weight. Depending on a setup switch that

determines whether the receiving transactions are recorded based on

inventory units or vendor units, this field may be automatically calculated.

Shipped weight is not generally used for consignment inventory as

the product was sent in advance to the usage.

- Shipped Vendor

Units is an optional field to enter the shipped vendor units

if the vendor is being paid based on shipped weight. Depending on

a setup switch that determines whether the receiving transactions

are recorded based on inventory units or vendor units, this field

may be automatically calculated. Shipped units are not generally used

for consignment inventory as the product was sent in advance to the

usage.

- Net Payment Weight

is a calculated field that is used when the assay result modifies

the weight that the vendor will be paid for the product. In the assay

definition in or Ingredient

Versions, the Scan Comparison value is set to Weight Adjustment.

- Net Payment Vendor

Units is a calculated field the will be calculated then Net

Payment Weight option is used. The units will be based on the weight

adjusted and in inventory units for each vendor unit.

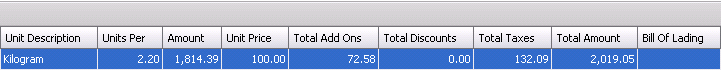

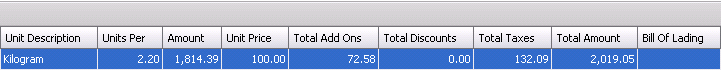

- Unit Description

is derived from the PO, displaying the unit of measure from

which the product was purchased from the vendor.

- Units Per

derived data from PO indicating the number

of units in each vendor unit.

- Amount

is a calculated field for the Received/Shipped Vendor Units x Unit

Price.

- The Unit Price

defaults from the PO with no option to modify at transfer.

- Total Add-ons

is a calculated total amount of premium add-ons that will be added

to the vendor payment based on the amounts defined in the purchase

order. Details are located in child grid.

- Total Discounts

is a calculated total amount of discount add-ons that will be deducted

from the vendor payment based on the amounts defined in the purchase

order. Details are located in child grid.

- Total Taxes

is a calculated amount based on the taxable product and/or add-ons

as defined in the purchase order. Details are located in the child

grid.

- Total Amount

is a calculated total amount of the receiving transaction based on

the amounts that are defined in the purchase order.

- Bill of Lading

is a location to enter the bill of lading reference for the receiving

line.

Additional

Line Details

Within the Complex Po No field, there is a child grid containing additional

details relating to the ingredients receiving.

Tax codes as defined on the purchase order will default to the receiving

transaction. The amount will be calculated based on the rate that is in

effect on the receiving date. There are two types of taxes.

- Accrual Taxes:

Will record the tax accrual and record the journal transaction at

time of receipt.

- Invoice Taxes:

Will calculate the tax at time of receipt, however the journal transaction

is not created until the purchase invoice is processed. Invoice taxes

are generally used for federal taxes that are reimbursed to the company

by the government and cannot be actually recorded until the vendor

invoice is received.

- Tax No

identifies the tax code.

- Tax Name

displays a description of the tax code.

- Amount

displays the total amount of taxes.

Premium and discount add-ons default from the purchase order. Amounts

will be calculated based on the amounts defined on the purchase order

and the number of units transferred from consignment. All amounts will

be accrued and recorded at transfer, however only add-ons with the Payment

Type=Transaction will be transferred to the vendor invoice for payment.

- Product No

displays the code of the selected add-on.

Transaction Basis is a read-only

field that defaults from the selected add-on and determines how the

add-on is calculated on orders. Options are: Per Unit, Percentage,

Flat Rate, or Free Percentage.

Payment

TypeTransaction:

Processed with the sales invoice.

Rebate: Processed at a date later than the invoice..

Internal: An internal transaction is a transaction that is not invoiced

to an external source (Example: There is an internal haulage

department that gets a credit for hauling products).

is a read-only field that derives from the purchase order and determines

when the add-on payment is made.

Payee Type is an optional field

that indicates the source type for the premium or discount add-on.

Transaction

Entity ID is a required field if a different Payee Type is

selected. If Payee Type is set, the selected vendor or cost

center name will appear in this field.

Taxable identifies if the item is

taxable or non-taxable when the add-on is purchased. The flag will

be selected if the item is taxable.

Amount displays the total cost of

the add-on.

Post a

Consignment Transfer

Once the consignment transfer has been created and saved, the transfer

needs to be posted. The posting process locks the consignment transfer

to prevent edits, and creates the journal transaction to record the liability.

The UnPost option unlocks the transfer and reverses the journal transactions.

Once the consignment transfer has been posted, the can be processed to pay the vendor.

- In the Ingredients Consignment Transfer index,

select the required transfer transaction and right-click to select

'Post'. Alternatively, click the green check mark

in the top menu bar and select 'Post'. Posting the record will move

the product from consignment to mill inventory. Once this transaction

is complete, the product can be used as required throughout the process.

in the top menu bar and select 'Post'. Posting the record will move

the product from consignment to mill inventory. Once this transaction

is complete, the product can be used as required throughout the process.

- To un-post a receiving, select the required receiving

transaction and right-click to select 'UnPost' or select Options>UnPost.

This process will set the transaction status to Reversed which allows

the transaction to be edited. The unposting process will also reverse

the journal transaction created in the post process.

Journal

Transaction

The posting process creates the journal transaction. The journal will

record the product to inventory and create the accounts payable accrual.

| DEBIT |

Ingredient

Inventory |

| CREDIT |

Accounts Payable Accrual |

![]()

to create a new consignment

transaction.

to create a new consignment

transaction.

to

create a new Consignment PO Inventory screen.

to

create a new Consignment PO Inventory screen.

in the top menu bar and select 'Post'. Posting the record will move

the product from consignment to mill inventory. Once this transaction

is complete, the product can be used as required throughout the process.

in the top menu bar and select 'Post'. Posting the record will move

the product from consignment to mill inventory. Once this transaction

is complete, the product can be used as required throughout the process.