![]()

Ingredients are first created at the global level and then be configured by feed mill in Ingredient Versions. Ingredients are defined as products. In order to either purchase or sell ingredients, relationships must be defined for the vendor sku and the sales sku.

Other features related to Ingredients.

Prior to creating an Ingredient Product, the following items should be created.

The following features are outlined in this document:

The Ingredient Products screen has several tabs that must be completed in the creation process.

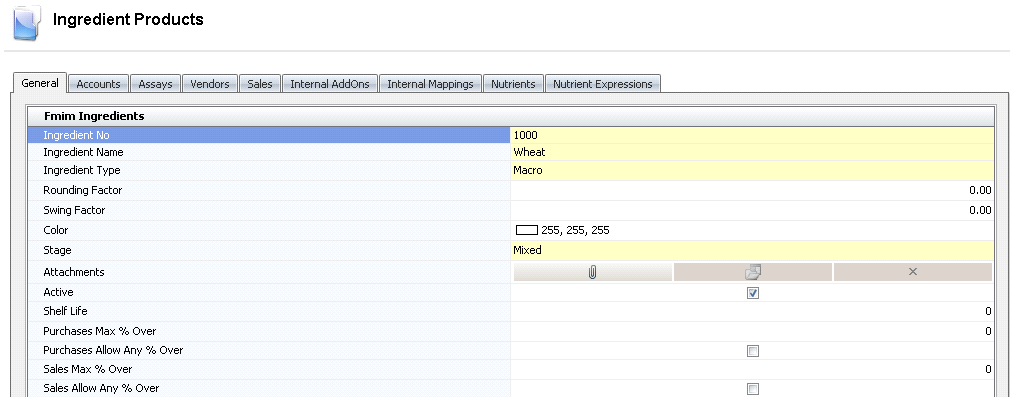

The General tab contains the base data for the ingredient.

In General>General>Products, select Ingredients.

In the Ingredient

Products index, click  to create a new ingredient product.

to create a new ingredient product.

Click on the General tab.

Enter the Ingredient No to identify the product within the system (alphanumeric, max 50 characters).

Enter the Ingredient Name as a description for the product (alphanumeric, max 250 characters).

Enter the Ingredient Type. Options available are: Liquid, Macro, Micro, Pre-Mix, and Rework.

The Rounding Factor is used to round the ingredient quantity when the FFA module returns a value for the required quantity.

The Swing Factor identifies the percentage that the ingredient can change in the FFA process. If using the FFA module, enter the percentage change that can occur for the ingredient. This value can be further defined in Ingredient Versions.

Ingredients can be Color coded for easy view for planning purposes. If desired, choose the color from the color grid.

Enter the Stage type for the ingredient. Options available are:Mixed, Post Blending, and Sprayed. This field is only used for filtering or reporting as there is no logic assigned to any of the stages.

In the Attachment field, any type of file can be attached (Example: Word document, picture, music or video clip)

The Active flag will be selected by default. If the product is no longer utilized, the active flag is required to be unchecked.

In the Shelf Life field, enter the number of days the ingredient can be used after the receive date. This field is used for planning in FFA.

Purchases Max % Over is used when the product has a tolerance percentage for the receiving transaction. (Example: The purchase order has 100 units. Max % Over is defined as 5%, which means the receiving transaction will allow up to an including 5 additional units).

Purchases Allow Any % Over can be selected if there is no limit and the purchaser can receive any quantity over the product units.

Sales Max % Over is used when the product has a tolerance sales amount for the receiving transaction. (Example: The sale order has 100 units and the Sales Max % Order is defined as 10%, which means the shipment transaction will allow for an additional 10 units to be shipped).

Sales Allow Any % Over is selected when there is no limit of shipping product units over what the customer has ordered.

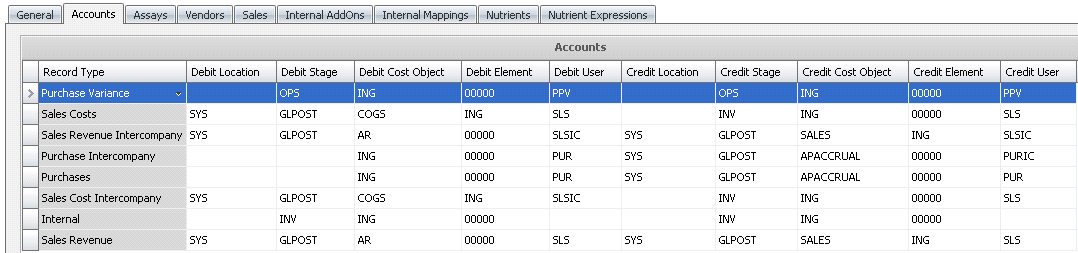

The default accounts established for the ingredients are defined on the accounts tab. It is highly recommended that the default accounts are not modified as there is logic that exists within the system for the defined accounts. If the account segment is blank, the system will determine the proper segment when posting the transaction and creating the journals. Further details related to chart of accounts can be noted in Chart of Accounts.

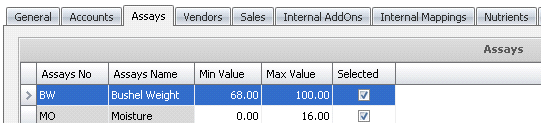

Assays need to be defined in Admin>Business>General>Definitions>Lab Test>Lab Test Codes prior to being assigned to the ingredients. The default assays are assigned to the ingredients at the global level and then can be further defined by feed mill if required. The assays selected at the global or feed mill level will default to the purchase order where the default minimum and maximum values can be modified if required. If necessary, there is the option to apply penalties or bonuses to the vendor based on the assay value determined at time of receiving. The penalties or bonuses can be defined by ingredient at a global level or by feed mill.

The list of assay codes that have been predefined for ingredients will default to the ingredient product.

Click on the Selected field to select the assays that pertain to the product. If the assays are global for all mills, the assays will default to Contracts and Purchase Orders based on the assays selected in the ingredient. Otherwise, if the assay is defined on the Ingredient Version,, it will override the assays defined on the ingredient product.

Assay No is the code defined for the assay.

Assay Name is a description for the assay that will usually appear on reports and forms.

In the Min Value field, enter the minimum acceptable value for the assay. The type of value is dependent on how the assay is tested such as an acceptable percentage.

n the Max Value field, enter the maximum acceptable value for the assay. The type of value is dependent on how the assay is tested such as an acceptable percentage.

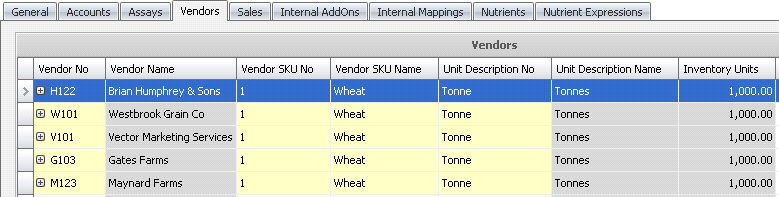

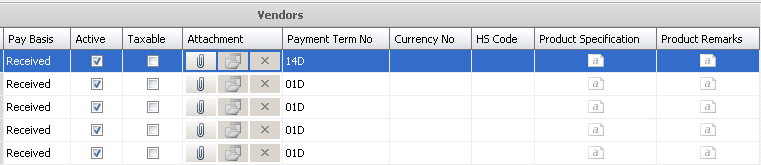

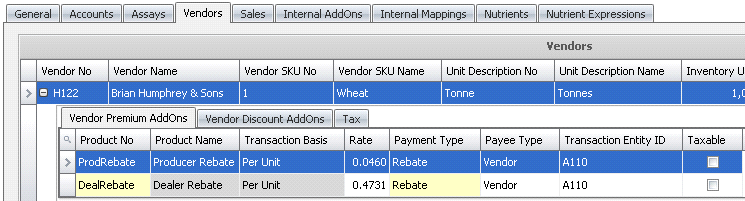

Before an ingredient can be purchased, the vendor/product relationship must be established. This option allows the user to define the unit of measure and any additional costs or discounts associated with the ingredient. If the product is purchased from the same vendor in different units, a vendor sku must be created for each unit.

Vendor No contains a list of previously defined vendors. Select the vendor where the product is purchased from.

Vendor Name displays the name of the selected vendor.

In the Vendor SKU No field, enter the code that is used when ordering the products from the vendor (alphanumeric, max 50 characters). This is optional and can be the same as the product code; however the vendor SKU must be unique to the vendor.

In the Vendor SKU Name field, enter a description of the product that is being purchased. The field will be displayed on purchase orders (alphanumeric, max 100 characters).

In the Unit Description No field, select the required unit of measure in which the product will be purchased. The Unit Description No must be predefined in Admin>Business>General>Definitions>Units of Measure prior to being selected on the Vendors tab. Examples: tons, lbs, tonnes, kg, drum, box, etc.

The Unit Description Name will default based on the selected Unit Description No.

Inventory Units indicates the number of units that will be added to inventory when the vendor unit is received. (Example: If an ingredient is purchased in tonnes, for every 1 tonne received, the inventory will be increased by 1000 kgs ). This value defaults based on the selected Unit Description No.

The system will default the vendor SKU as Active. If the ingredient is no longer purchased from the vendor, de-select the option.

If the product is Taxable, the flag must be checked to calculate taxes on the product. The tax code can be optionally added to the Vendor SKU, but must be added to the purchase order for taxes to be calculated.

In the Attachment section, any type of file can be attached (Example: Word document, picture, music or video clip).

Payment Term No displays the payment terms and defaults from the vendor, with an option to select by product.

Currency No defaults from the vendor and displays the code for the currency, with an option to modify by product.

HS Code represents Harmonized System Code, which is used for international shipments. Enter the code based on the international defined code.

Product Specification is a text field to enter details related to the product vendor SKU.

Product Remarks is a text field to enter any other details specific to the vendor sku.

In the child grid within the Vendor No, there is the option to define the add-ons related to the product. The add-ons must be pre-defined in General>Products>AddOns prior to adding to the vendor sku. Depending on how the add-ons are configured, the cost of the add-on can be included or excluded from inventory cost of the product. The add-ons can be configured to be included in the cost of the product or alternatively, be coded to an entirely different account which is not included in the product cost.

There are two types of add-ons:

Premium add-ons add to the cost of the product.

Discount add-ons reduce the cost of the product.

In the Product No field, select from a list of previously defined add-ons codes. The add-ons will transfer to purchase orders created for the vendor SKU. Add-ons can be found in: General>Products>AddOns

Product Name is a read-only field that displays the description of the add-on product type.

Transaction Basis is a read-only field that defaults from the selected add-on and determines how the add-on is calculated. Options are: Per Unit, Percentage, Flat Rate, or Free Percentage. Free Percentage is currently only used in poultry products.

Payment Type determines when the add-on payment is made. Options available are:

Transaction: Processed at time of receiving and will be included in the vendor payment.

Rebate: Will record accrual amount at time of receiving but will not transfer to the invoice. Payment/invoice will be processed at a later date.

Internal: An internal transaction that is not invoiced to an external source (Example: There is an internal haulage department that gets a credit for hauling products).

The Payee Type field is optional. If the add-on is to be processed by an alternative sources, select the source type for the add-on. Options are: Customer, Vendor, Employee, or Cost Center. If the field is left blank, it assumes the vendor sku for the payment of the add-ons.

Transaction Entity ID is a required field if a different Payee Type is selected. Select the appropriate vendor or cost center.

Taxable identifies if the item is taxable or non-taxable when the item is purchased. Tax codes must be assigned to the purchase order for the taxes to be calculated.

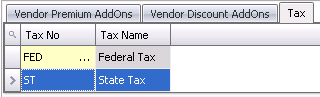

If the product and/or add-ons are taxable, the tax codes can optionally be defined at the vendor sku. It is recommended that the tax codes are only entered on the vendor sku if that vendor only delivers within the same state or province, as different tax rate can be applied depending on the destination. Tax codes must be previously defined. Rates will default to the purchase order based on the rate that is in effect on the purchase order date.

Tax No is selected from the predefined in Admin>Business>General>Definitions>Tax Codes. The tax code will default to purchase contracts and purchase orders for the vendor sku.

Tax Name defaults from the selected Tax No.

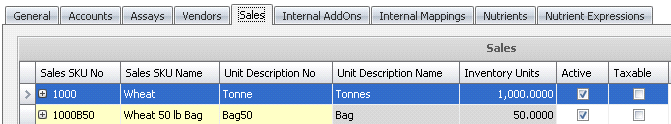

If the ingredient is sold to external sources, a sales sku must be created prior to creating a sales order.

In the Sales SKU No field,enter a unique code that will be used in creating sales contracts, orders, and price lists (alphanumeric, max 50 characters). This is optional and can be the same as the product code, however the sales sku must be unique within the Sales tab.

In the Sales SKU Name field, enter a description for the sales SKU. This will normally print on orders and invoices (alphanumeric, max 100 characters).

In the Unit Description No field, select the required unit of measure that the product will be shipped. The Unit Description No must be predefined in Admin>Business>General>Definitions>Units of Measure prior to being selected on the Sales tab.

The Unit Description Name will default based on the selected Unit Description No.

Inventory Units indicates the number of units that will be removed from inventory when the sales sku is shipped. (Example: If an ingredient is sold in tonnes, for every 1 tonne shipped, the inventory will be reduced by 1000 kgs ). This value defaults based on the selected Unit Description No.

New sales skus' will default as Active. If the sales sku is no longer required, de-select the Active flag.

If the product is Taxable, the flag must be checked in order for taxes to calculate on the product. Tax codes must be entered on the price list, sales code, sales contract, or sales order for the taxes to be calculated.

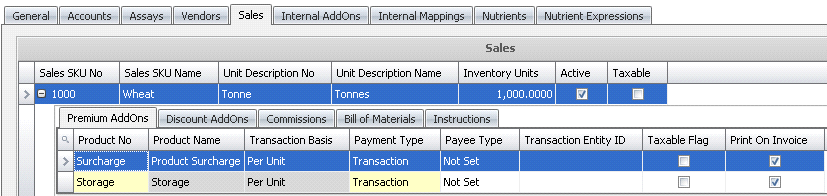

In the child grid within the sales sku, there is the option to define additional details such as added charges, discounts or commissions on the product.

The add-ons must be pre-defined before adding to the sales sku. The add-ons can be configured to be included in the revenue of the product or alternatively, be coded to an entirely different account which is not included in the product revenue. There are two types of add-ons:

Premium add-ons add to the price of the product.

Discount add-ons reduce the price of the product.

In the Product No field, select from a list of previously defined premium add-on codes. Add-ons must be selected on the sales sku before being transferred to a contract, price list, or order. Add-ons must be predefined in General>Products>AddOns.

Product Name displays the description of the selected add-on as defined.

The Transaction Basis is a read-only field that defaults from the selected add-on and determines how the add-on is calculated. Options are: Per Unit, Percentage, Flat Rate, or Free Percentage. Free percentage is currently only used in poultry products.

Payment Type determines when the add-on payment is made. Options available are:

Transaction: Processed at time of receiving and will be included in the vendor payment.

Rebate: Will record accrual amount at time of receiving but will not transfer to the invoice. Payment/invoice will be processed at a later date.

Internal: An internal transaction that is not invoiced to an external source (Example: There is an internal haulage department that gets a credit for hauling products).

The Payee Type field is optional. If the add-on is to be processed by an alternative source, select the source type for the add-on. Options are: Customer, Vendor, Employee, or Cost Center. If the field is left blank, it assumes the customer for the add-ons.

Transaction Entity ID is a required field if a different Payee Type is selected. Select the appropriate customer or cost center.

Taxable Flag identifies if the item is taxable or non-taxable when the item is purchased. Tax codes must be assigned to the sales order for the taxes to be calculated.

Select Print on Invoice if the add-on is to be printed on the default system invoice. If the add-on is not to be printed on the invoice, the option should not be selected. This option can be further defined in price lists.

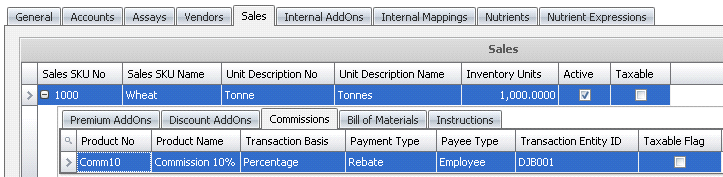

Commissions are a type of add-on that is typically used to pay employees or other parties based on a percentage or per unit amount.

In the Product No field, select from a list of previously defined premium add-on codes. Add-ons must be selected on the sales sku before being transferred to a contract, price list, or order. Add-ons must be predefined in General>Products>AddOns.

Product Name displays the description of the selected add-on as defined.

The Transaction Basis is a read-only field that defaults from the selected add-on and determines how the add-on is calculated. Options are: Per Unit, Percentage, Flat Rate, or Free Percentage.

Payment Type determines when the add-on payment is made. Options available are:

Transaction: Processed at time of receiving and will be included in the vendor payment.

Rebate: Will record accrual amount at time of receiving but will not transfer to the invoice. Payment/invoice will be processed at a later date.

Internal: And internal transaction that is not invoiced to an external source (Example: There is an internal haulage department that gets a credit for hauling products).

The Payee Type field is optional. If the add-on is to be processed by an alternative sources, select the source type for the add-on. Options are: Customer, Vendor, Employee, or Cost Center. If the field is left blank, it assumes the customer for the add-ons.

Transaction Entity ID is a required field if a different Payee Type is selected. Select the appropriate customer or cost center.

Taxable Flag identifies if the item is taxable or non-taxable when the item is purchased. Tax codes must be assigned to the sales order for the taxes to be calculated.

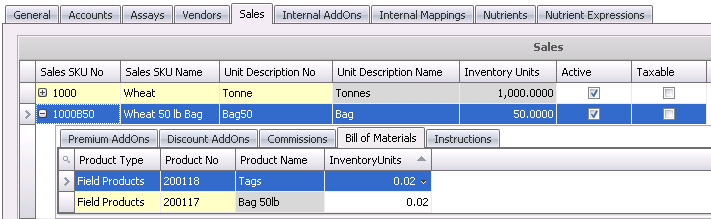

The Bill of Materials tab is typically not used to ship ingredients as the ingredient is typically shipped in bulk. However, if required, field products can be assigned to ingredients and the usage automatically created when the ingredient is shipped.

Product Type determines the type of product that will be used in the Bill of Materials. Any inventory product type can be selected.

Based on the selected product type, a list of available products will be available. Select the Product No that is required for the product to be shipped.

Product Name will default based on the selected product.

Inventory Units determines how many product units are required for each Bill of Material product. For example, to use the Tags example from above, one tag will be required for each bag. Therefore, enter the units as 1/50 = 0.02. This will calculate one tag for every 50 lb bag.

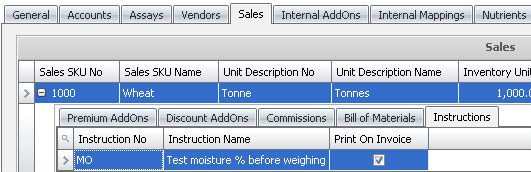

Instructions are default comments that are applicable to the product. These instructions are predefined in Admin>Business>General>Definitions>Instructions. Instructions are generally used to print on specific documents such as sales confirmations, invoices and hatchery work orders.

From Instruction No, selects the instruction for the product that is predefined in Admin>Business>General>Definitions>Instructions.

Instruction Name displays the description of the selected Instruction No. The Instruction Name will be the text that prints on the various forms or reports.

If the instruction is to print on the default system invoice, select the Print On Invoice option. If the instruction is not required to print on the default invoice, the option is not selected. These options can also be used in custom reports.

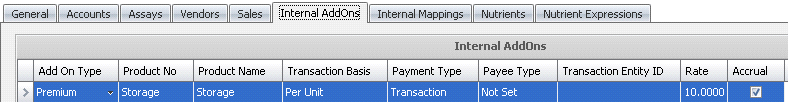

Internal add-ons are used when transferring ingredients between mills. The add-on must be defined on this tab before the pricing is established in Internal Pricing.

From Add-On Type, select whether the internal add-on is a premium or discount add-on. Premium will increase the cost to the destination cost center while the discount will reduce the cost to the destination cost center.

In the Product No field, click the box to select from a list of previously defined premium or discounts add-ons.

Product Name displays the description of the selected add-on as defined.

The Transaction Basis is a read-only field that defaults from the selected add-on and determines how the add-on is calculated. Options are: Per Unit, Percentage, Flat Rate, or Free Percentage.

Payment Type determines when the add-on cost is recorded. Options available are:

Transaction: Processed at time of transfer and will be included in the transfer journal.

Internal: Used when another department is required to be credited or debited for the add-on (Example: There is an internal haulage department that gets a credit for hauling products).

The Payee Type field is only required if the Payment Type is set to Internal. If this is the case, then the Payee Type should be set to Cost Center.

Transaction Entity ID is a required field if a Cost Center is selected as the Payee Type. Select the cost center that will receive the debit or credit for the add-on amount..

If the Rate is standard for all transactions, enter the rate in this field. If the rate is defined by cost center, then rates must be applied in Internal Pricing.

Accrual is selected if the amount of the add-on is reversed at period end with the internal price of the product. There is a separate period end task that will reverse any add-ons with the accrual option selected. If the option is not selected, the cost of the add-on will not be reversed at period end.

Internal mappings are not currently used in ingredient products.

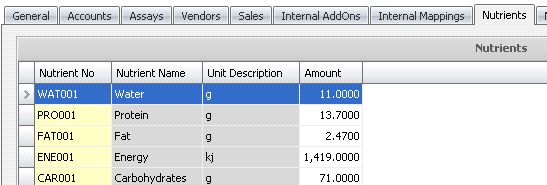

Nutrients must be established in Admin>Business>>FMTS>FMIM>Nutrients prior to being selected on the ingredient. The Amount is entered on a per inventory unit basis, in either lbs or kgs.

.

.

to

add a nutrient to the feed formula. Nutrients must be predefined in

Admin>Business>>FMTS>FMIM>Nutrients

prior to selection.

to

add a nutrient to the feed formula. Nutrients must be predefined in

Admin>Business>>FMTS>FMIM>Nutrients

prior to selection.Nutrient Expression is used in feed formulation. Nutrient Expressions are defined in FMTS>FFA>Master Data>Nutrient Expressions.

There are three options available for ingredient products:

The Reset Default Accounts sets the Product>Accounts tab back to the system defined default accounts. This process can be initiated from the index list or directly within the product.

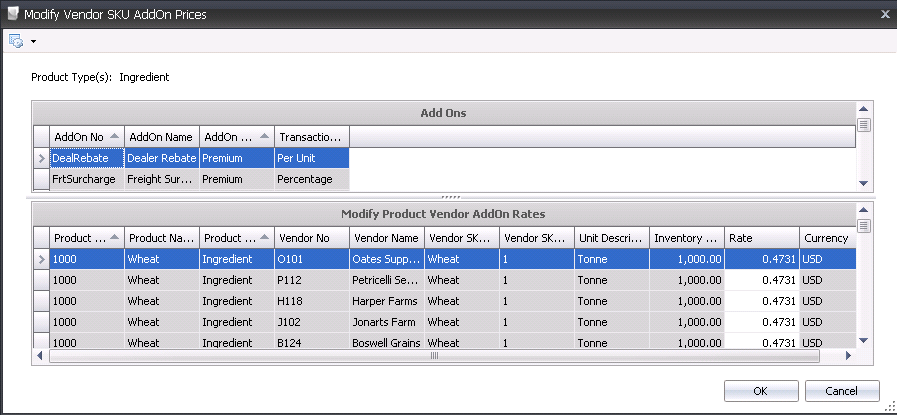

The Modify Vendor SKU Add-on Prices option allows the user to modify the add-on prices from a single data entry screen rather than having to access each product to modify the prices. The feature can be initiated from the product type index to only change add-ons for that specific product type or from General>Products>Master to change the add-on prices for all product types in one screen.

The Auto Refresh option is selected by default. This option updates the index immediately when changes are made to the products. If the auto refresh option is not required, de-select the option and the index must be manually refreshed by the user.