vendors

A vendor is a company or person that will

supply goods or services. Vendors are used throughout the purchasing process

and intercompany transactions. Third party feed mills, plants, hatcheries

and warehouses are all required to be assigned to vendors for transactions

to be created. Vendors are also assigned to farms for grower payments

and intercompany transactions. Vendors reside in General>Master

Data>Vendors, which contains the basic information required

to process purchase transactions.

Table Names: ProteinVendors, ProteinVendorsBusiness,

ProteinVendorsContacts, ProteinVendorContactDetails, ProteinVendorDetails

Create a Vendor

There are several tabs available to enter

the vendor details.

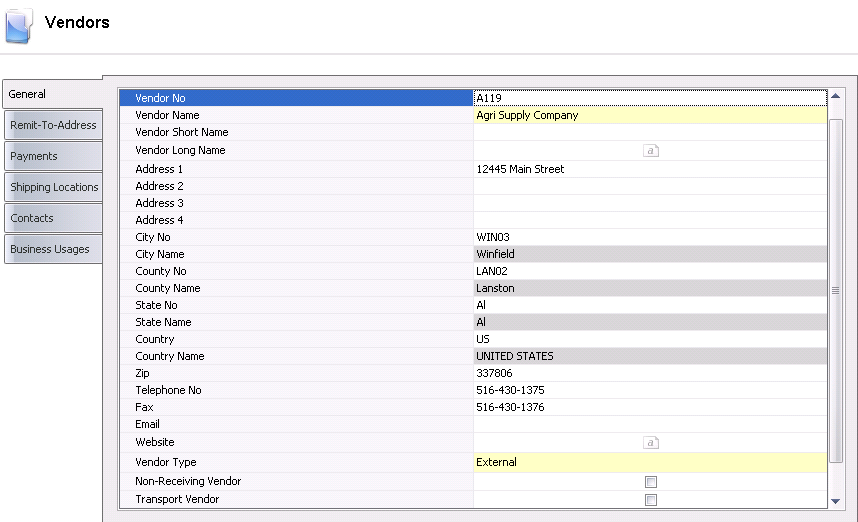

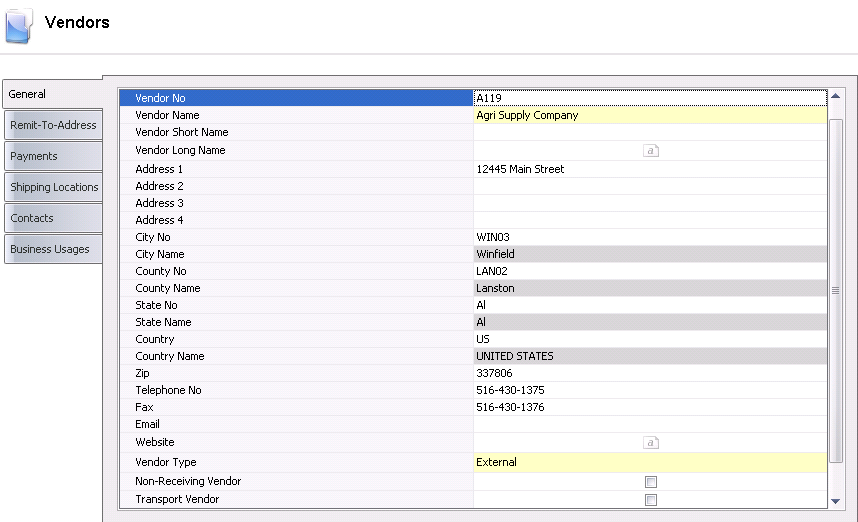

General

The General tab is used to enter the basic details for the vendor.

- In General>Master

Data, select Vendors.

- In the Vendors

index, click

to create a new vendor record.

to create a new vendor record.

- In the Vendor

No field, enter the code that is used to identify

the vendor (alphanumeric, max 20 characters).

- In the Vendor

Name field, enter the name to identify the vendor (alphanumeric,

max 50 characters).

- Vendor Short

Name is an optional field to enter a short-form or common name

for the vendor (alphanumeric, max 50 characters).

- In the Address

1-4 fields,

enter the address details for the vendor.

- From City

No, select the city code for where the selected

vendor is located. City Name

will default from City No, and displays the name of the city in which

the selected vendor is located. Cities must be predefined in .

- From County

No, select the county code for where the selected

vendor is located. County Name will

default and displays the name of the county in which the selected

vendor is located. Counties must be predefined in .

- From State

No, select the state code for where the selected

vendor is located. State Name

will default and displays the name of the state in which the selected

vendor is located. States must be predefined in .

- From Country,

select the country code for where the selected vendor is located.

Country Name will default

and displays the name of the country in which the selected vendor

is located. Countries must be predefined in .

- In the Zip/Postal

Code field,

enter the zip code or postal code for the vendor.

- In the Telephone

No field, enter the main telephone number for

the customer. Additional contact information can be entered on the

Contacts

tab.

- In the Fax

field, enter the main fax number for the customer.

- In the Email field, enter

the main e-mail address for the customer (if applicable).

- In the Website field,

enter the website address for the customer (if applicable).

- From Vendor

Type, select whether the vendor is an internal

or external vendor.

Internal

- The vendor belongs to the same organization and journal transactions

for the vendor are recorded to the intercompany purchase accounts

(PURIC).

External:

The vendor is external and journal transactions for the vendor

are recorded to the external purchase accounts (PUR).

- From Transport

Vendor, click to select if the vendor is a freight

vendor. Vendors must be defined as transport vendors to be assigned

to freight products or selected as a haulage vendor in purchase transactions.

- Non-Receiving

Vendor is selected if the vendor is used for purchase orders

but another vendor is paid for the product. Complete details are outlined

in .

- Internal AP Vendor

is a field required for grower settlements to identify the vendor.

- The Active

field indicates if the vendor is active or inactive. If the vendor

is no longer required, de-select the option.

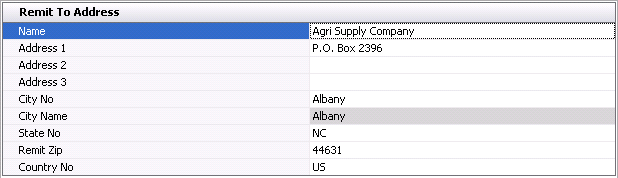

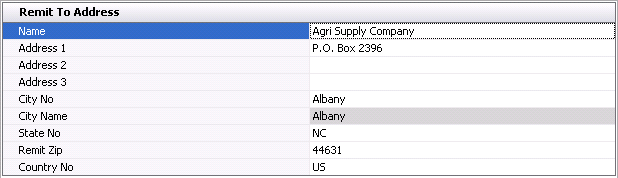

Remit-to-Address

The Remit-to-Address is an optional tab where the payment will be processed.

There is no logic assigned to this field and it is only used to interface

data to the financial system for payment if the vendors are created within

MTech. The Remit-to-Address tab is used if the purchase is made from Vendor

A but then Vendor B is paid.

- In the Name

field, enter the name to identify the vendor (alphanumeric, max 50

characters).

- In the Address

1-3 fields,

enter the address details for the vendor.

- From City

No, select the city code for which the selected

vendor is located. City Name

will default from City No, and displays the name of the city in which

the selected vendor is located.

- From State

No, select the state code for which the selected

vendor is located.

- In the Remit

Zip

field, enter the zip code or postal code for the vendor.

- From Country

No, select the country code for which the selected

vendor is located.

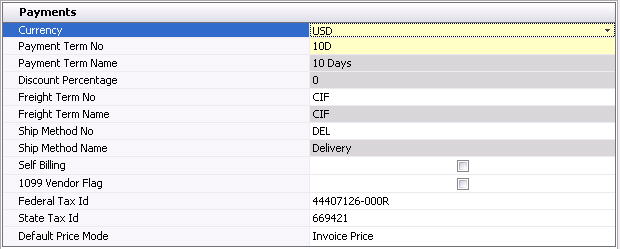

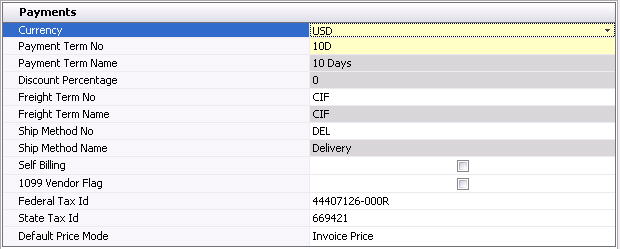

Payments

The Payments tab defines the vendor details related to payment processing.

- Currency

is a required field that indicates the default currency for the vendor.

The default currency will transfer to contracts and purchase orders

with an option to modify.

- Payment Term

No is a required field that defaults from the selected

vendor. Payment terms can be modified if required, on the contract

or purchase order.

- Payment Term

Name defaults from Payment Term No and displays a description

of the payment terms.

- In the Freight

Term No field, enter the freight terms for the vendor. Some

commonly used terms are: FOB Origin, FOB Destination, and COF.

- Freight Term

Name defaults from Freight Term No and displays the name of

the freight terms.

- In the Ship

Method No

field, the user has the option of associating

a shipping method to the vendor. This field is only used for reporting

with no associated logic.

- Ship Method Name

defaults from Ship Method No and displays the required method of shipping.

- Select the Self-Billing option

if the vendor does not supply an invoice, and payment is processed

based on the receiving transaction. There is a specific purchase invoice

type that processes payments for self-billing vendors.

- Select the 1099

Vendor Flag option if this vendor is required for 1099 reporting.

- In the Federal

Tax ID

field, enter the federal tax identification code.

- In the State

Tax ID

field, enter the state tax identification mode.

- Default Price

Mode determines the default price mode for the vendor. The

price mode can be changed in the contract or purchase order if required.

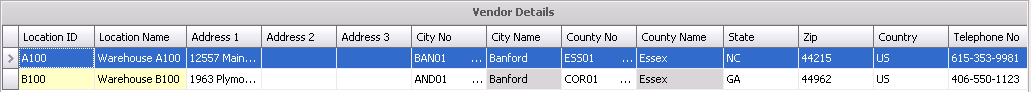

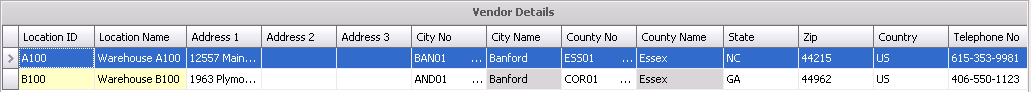

Shipping Locations

The Shipping Locations tab is optionally used to enter the address details

for the multiple locations that the vendor can ship products from. The

locations can be selected on the purchase order.

- From Location

ID, select the code that corresponds to the specified

shipping location.

- Location Name

will default from the selected Location ID, and displays the name

of the location.

- In Address

1-3 fields, enter the address of the location.

- From City No,

select the city code for which the location is located.

- City Name

will default and displays the name of the city in which the selected

vendor is located.

- From County

No, select the county code for which the selected

location is located.

- County Name

displays the name of the county in which the selected location is

located.

- Enter the State

of the location.

- In the Zip field, enter

the zip code of the location.

- Select the Country

of the location.

- In the Telephone

No field, enter the main telephone number for

the customer.

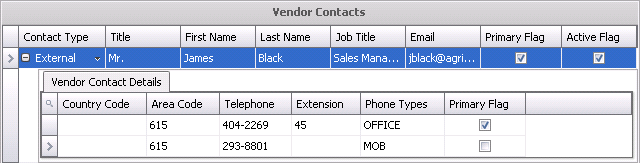

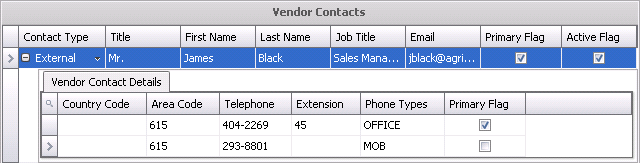

Contacts

The Vendor Contacts tab is used to define internal and external contacts

for the vendor. The Primary Flag is used to identify the main contact

information for the internal and external contacts. External contacts

are typically customer contacts while internal contacts are those within

the Company, such as the purchasing agent or buyer that may deal with

the vendor.

- From Contact

Type, select whether the contact is an External or Internal

contact.

- From Title,

select the appropriate title for the contact. Examples are: Mr, Mrs,

Ms.

- Enter the First

Name of the contact.

- Enter the Last

Name of the contact.

- Enter the Job

Title of the contact.

- In the Email

field, enter the Email address of the contact (if applicable).

- Select the Primary Flag

if the contact is the first contact to call for the customer

- The Active

Flag will be selected by default.

If the contact is no longer needed, de-select the active flag.

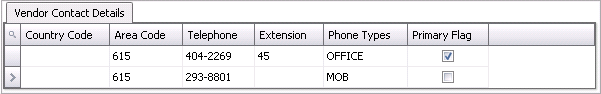

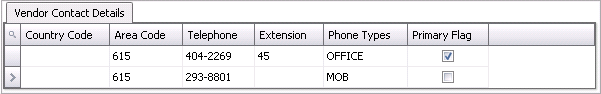

Additional Vendor Contact Details

Within the Vendor Contacts tab, there is a child grid that contains

additional information relating to the contact.

- In the Country

Code field, enter the code for the country that the vendor

is located in.

- In the Area

Code field,

enter the area code of the vendor's location.

- In the Telephone

field, enter the main telephone number for the vendor.

- Enter the Extension

of the telephone number (if applicable)

- From Phone Types,

select the type of phone number entered. Options must be predefined

in .

- Select the

Primary Flag if the contact is the first contact to call

for the vendor.

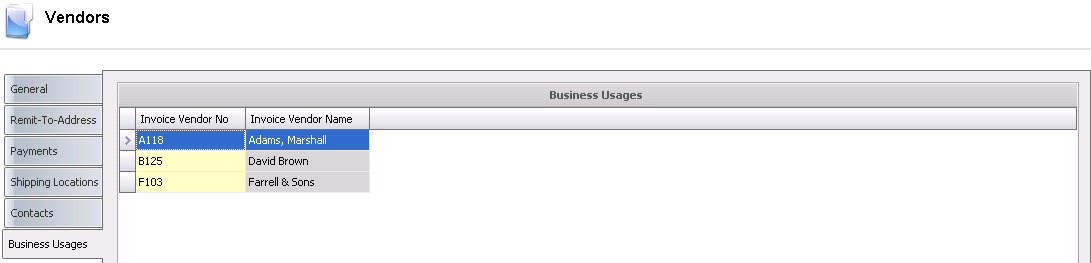

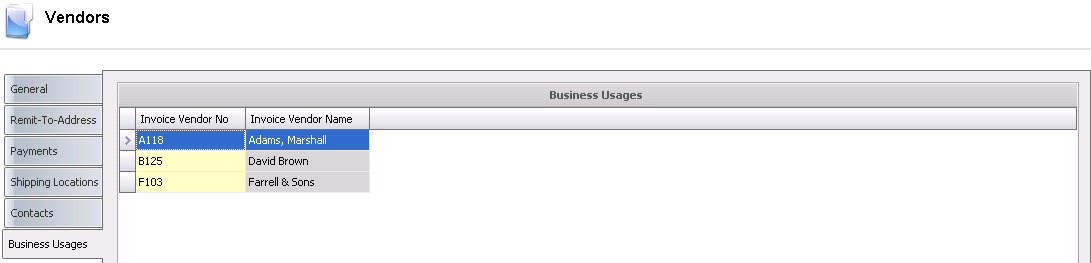

Business Usages

The Business Usages tab is only completed if the Non-Receiving Vendor

flag is selected on the General tab. The Business Usages tab defines the

invoice vendors that can be paid for product on a purchase order for the

non-receiving vendor. Complete details are outlined in .

- Select Business Usages tab

- Click

to

add an Invoice Vendor No.

to

add an Invoice Vendor No.

- Invoice Vendor

Name will default based on the selected Invoice Vendor No.

![]()

to create a new vendor record.

to create a new vendor record.

to

add an Invoice Vendor No.

to

add an Invoice Vendor No.