Self-billing invoices are used for vendors that do not supply invoices. The self-billing flag must be marked on the vendor in order to create a self-billing invoice. The payment will be made based on the receiving transaction amounts. This document outlines the steps to create a self-billing invoice.

The following options are outlined in the Self-Billing Invoice:

In General>Purchases>Invoices,

select the drop-down menu on the  and select Self Billing.

and select Self Billing.

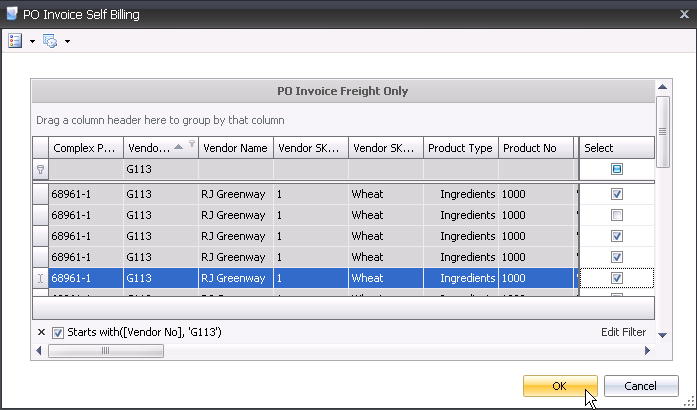

In the PO

Invoice Self Billing dialog, select the invoice lines that are required

to be invoiced. The dialog can be filtered by Vendor No or any other

fields to minimize the list of available transactions.

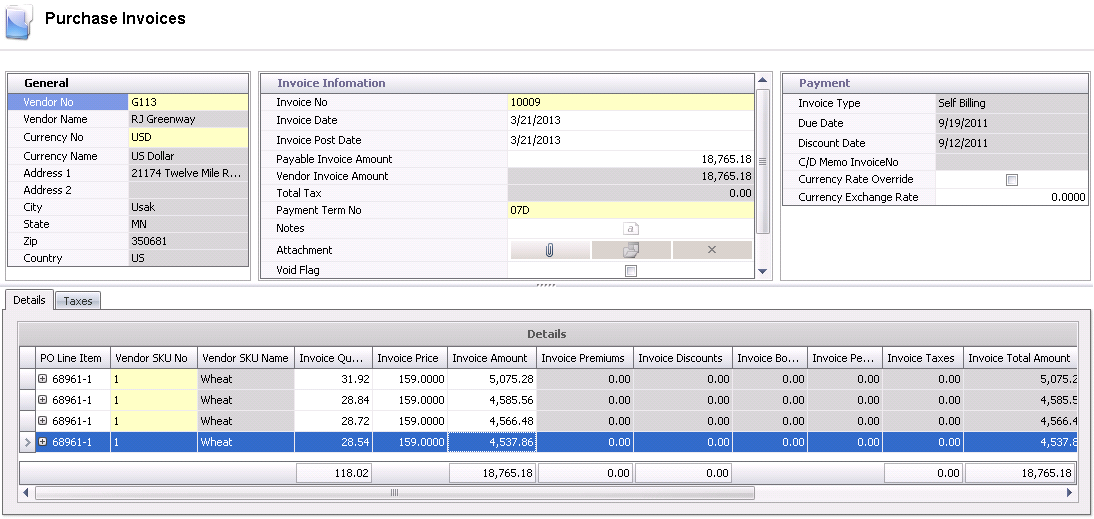

The Self-Billing invoice will be automatically created. The description for all fields related to a self-billing invoice can be reviewed in the PO Invoice document as the invoice is generated from receiving transactions.

Once the Self-Billing Purchase Invoice has been created and saved, the invoice needs to be posted. The posting process locks the purchase invoice to prevent edits, and creates the journal transaction to record the liability. The UnPost option unlocks the invoice and reverses the journal transactions.

In order for the invoice to be posted, it needs to be in Approved status. The invoice will automatically default to Approved status if the invoice amount matches the received amount exactly or within the defined tolerances.

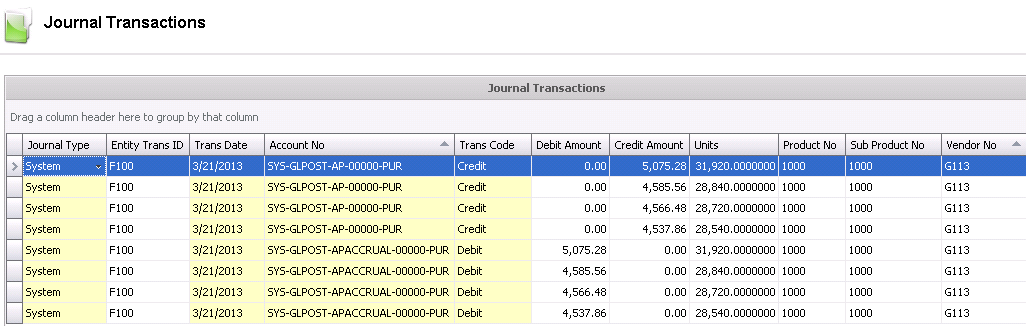

The posting process creates the journal transaction. The journal will reverse the accounts payable accrual that was incurred when the product was received and record the payable amount to the vendor.

| DEBIT | Accounts Payable Accrual |

| CREDIT | Accounts Payable |