prepaid purchase orders

MTech has the option to create purchase orders where the product must

be paid for prior to being shipped from the vendor. A purchase order will

be considered as prepaid if the prepaid option is selected for the assigned

payment term in .

The process of creating a prepaid purchase order includes the same options

as available in Create a Basic Purchase

Order. To view any of the specific requirements, select any of the

following links.

Create a Prepaid Purchase

Order

The following options are outlined in the Prepaid Purchase Order document:

Purchase Order Requirements

- Create a purchase order as outlined in Create

a Basic Purchase Order.

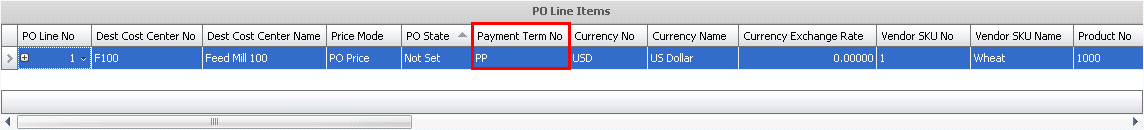

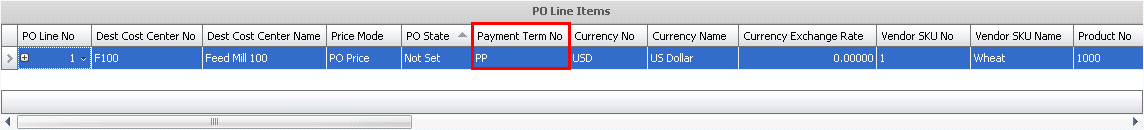

- In the PO Line

Items box, select a prepaid payment term.

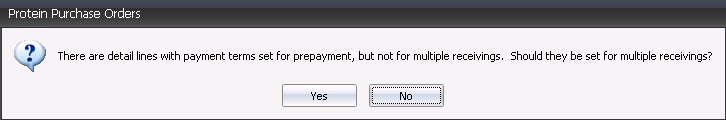

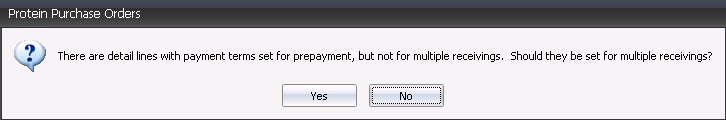

- When the purchase order is saved, the user will

be prompted with an option for multiple receivings for the prepaid

purchase order.

- Yes

- there will be multiple receiving transactions for the prepaid

purchase order. On the final receiving transaction, the Prepaid

Final Receiving flag must be selected. When this occurs, the journal

transaction for the receiving transaction will clear any remaining

accrual to the purchase price variance account.

- No

- there will be only one receiving transaction and the journal

transaction for the receiving transaction will record the full

amount to the purchase price variance account if there is are

any differences such as excess weight.

Create a Prepaid Purchase

Invoice

If the purchase order has been assigned a prepaid payment term, there

is a specific invoice type dedicated to prepaid invoices. The reason that

there is a separate invoice type is that given there are no receiving

details, the invoice must extract the payment details from the purchase

order rather than other invoice types where the details are extracted

from the receiving transaction.

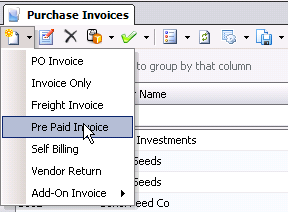

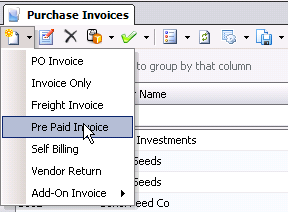

In General>Purchases>Invoices,

select the drop-down menu on the  and select Pre Paid Invoice.

and select Pre Paid Invoice.

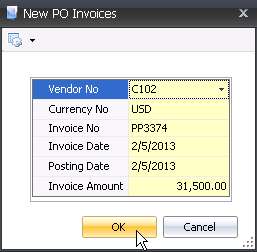

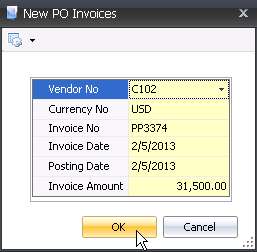

- In the New

PO Invoices box, enter the details related to

the prepayment and select OK to create the invoice.

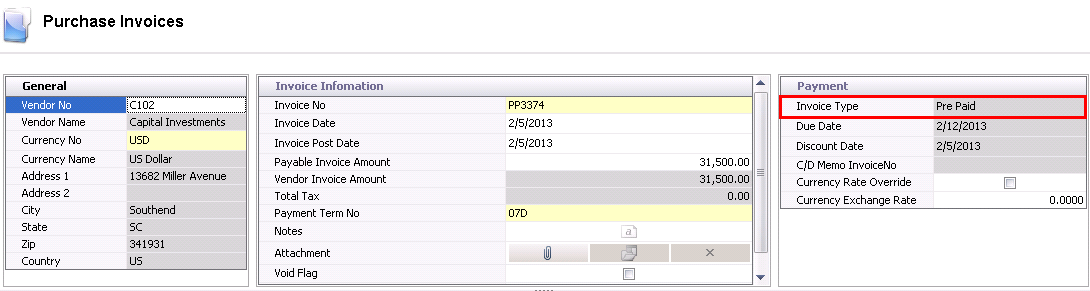

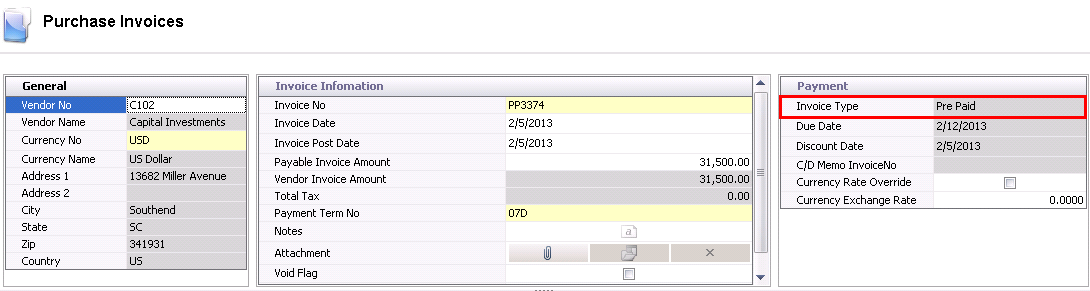

- The invoice header will be created with the Invoice

Type set to Pre Paid to indicate a prepaid invoice transaction.

Purchase Order Line Details

- To add the purchase order lines, click on the

Invoice Line Details and select

.

.

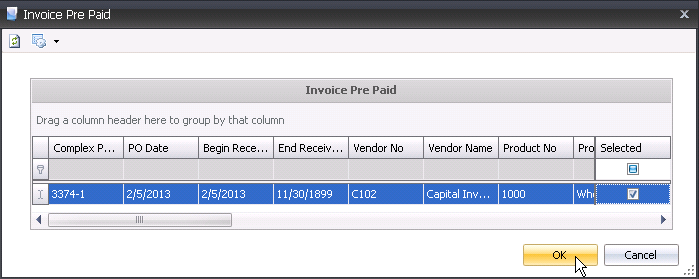

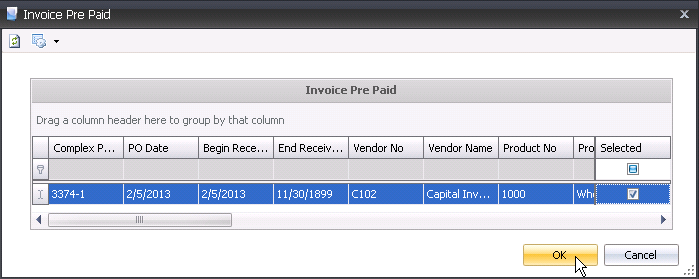

- In the Invoice Pre Paid selection dialog, select

the purchase order that is to be prepaid and select 'OK' to add the

purchase invoice lines.

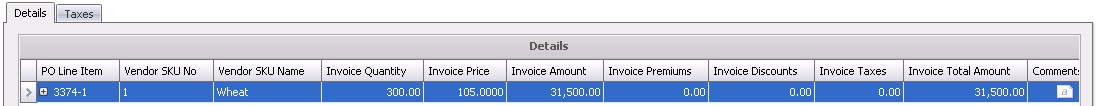

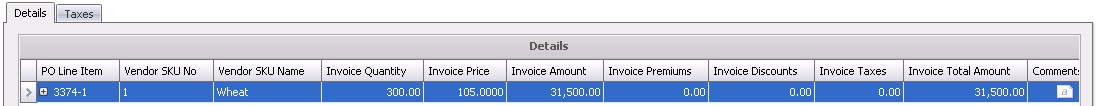

- The purchase order lines will default to the Details

grid based on the details that are defined in the purchase order.

The Details should not be modified.

- Click

to save the prepaid purchase invoice and close the transaction.

to save the prepaid purchase invoice and close the transaction.

Post Prepaid Invoice

Once the Prepaid Purchase Invoice has been created and saved, the invoice

needs to be posted. The posting process locks the purchase invoice to

prevent edits, and creates the journal transaction to record the liability.

The UnPost option unlocks the invoice and reverses the journal transactions.

- In the Purchase Invoice index, select the required

purchase invoice and right-click to select 'Post'.

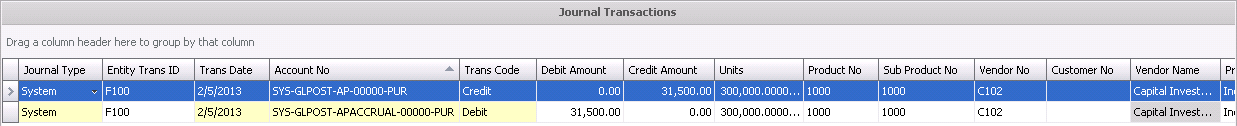

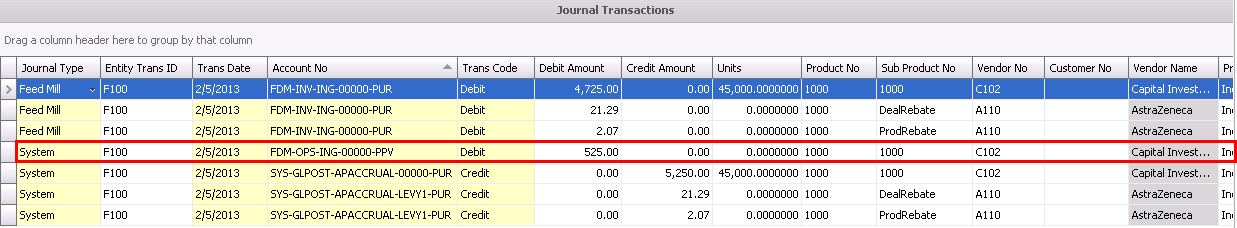

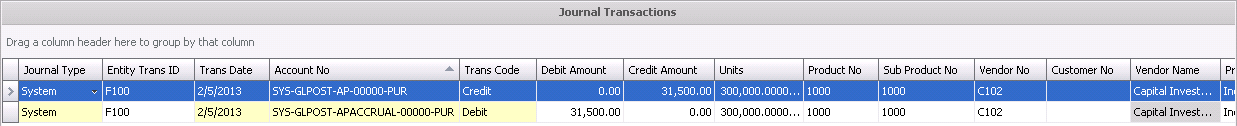

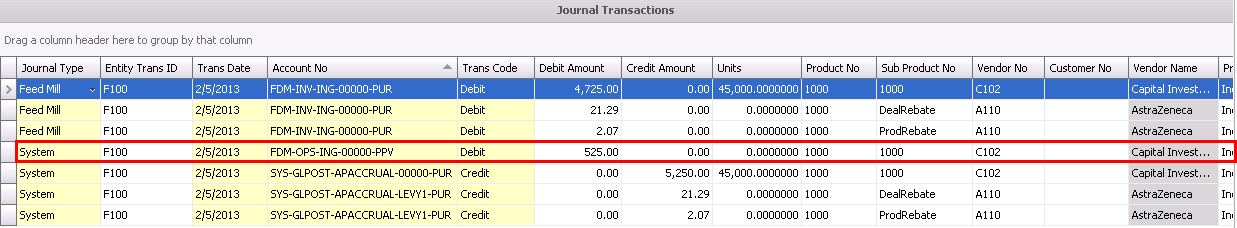

Journal Transaction

The posting process creates the journal transaction.

| DEBIT |

Accounts

Payable Accrual |

| CREDIT |

Accounts

Payable |

Create a Receiving

Transaction

The process for receiving a prepaid purchase order is the same as an

other receiving process. The only difference occurs for a prepaid purchase

order with multiple

receipts. The system looks to the Multiple Receiving flag in the

purchase order to determine if the Final Prepaid Receiving flag is required

to record the variance on a transaction.

- Single Receipt

- If the multiple receipt flag is not selected in the purchase order,

the receiving transaction will record any variances to the purchase

price variance account when the receiving transaction is posted.

- Multiple Receipt

- In the event that there are multiple receipts, the last receipt

must have the Final Prepaid Receiving flag marked. This process will

clear out any remaining amounts in the accrual account and expense

to the purchase price variance account.

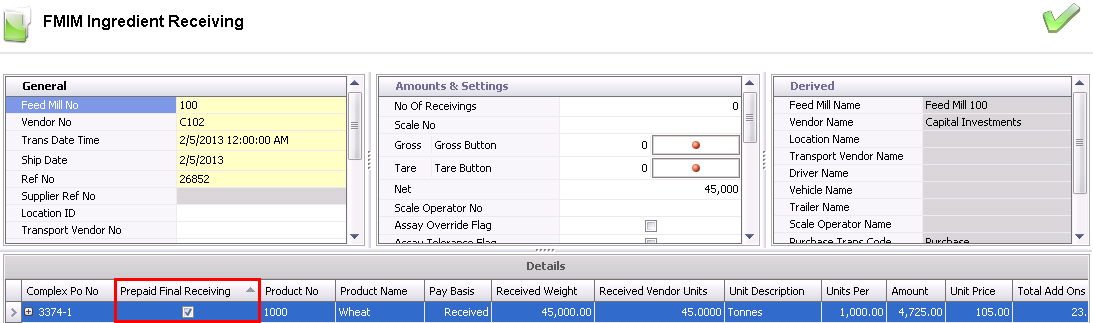

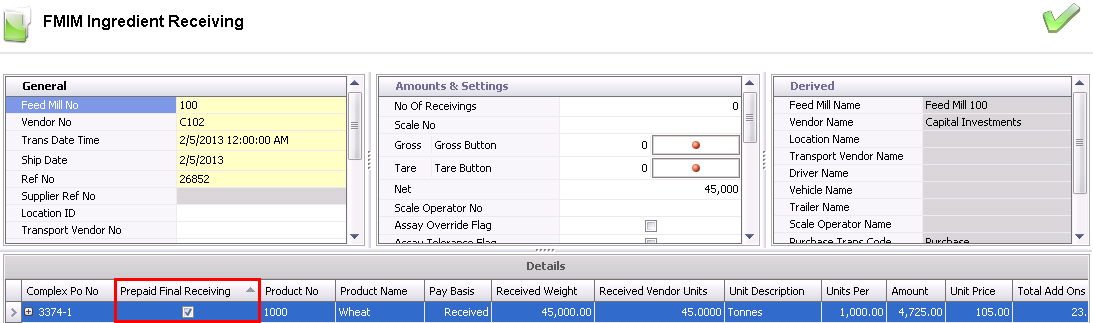

- Create a

Receiving Transaction for any product type.

- Select the Final

Prepaid Receiving flag on the product detail line (only required

on the final receiving for multiple receipts).

- Save and close the receiving transaction.

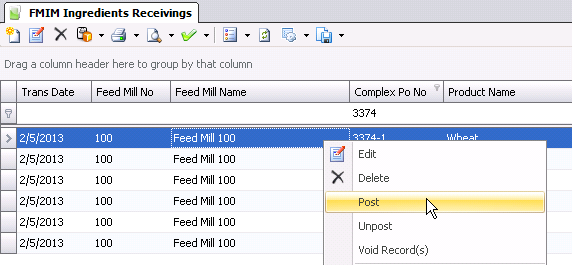

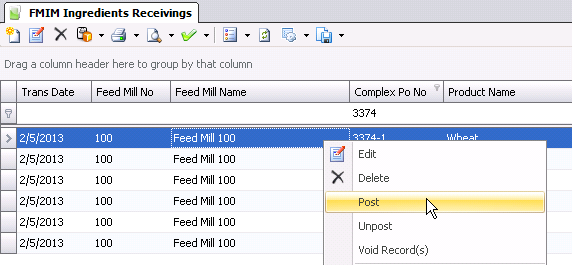

- Post the receiving transaction by selecting the

transaction and right-click to select Post.

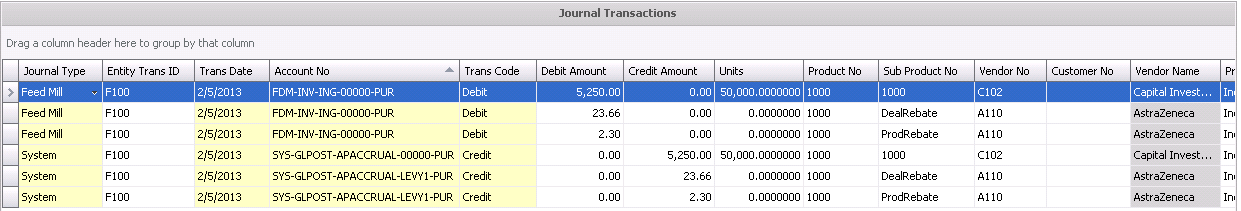

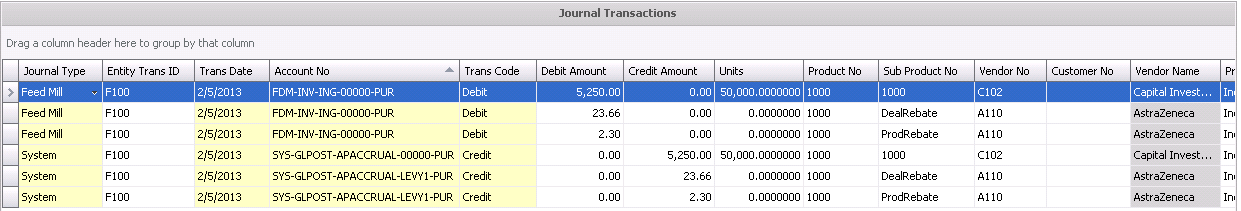

- The posting process will create a journal transaction

to record the amounts for the receiving transaction.

- If there is no difference from the purchase order

quantity and the received quantity; the journal transaction will simply

reverse the accrual and record the amount to inventory.

| DEBIT |

Product

Inventory |

| CREDIT |

Accounts

Payable Accrual |

- If t here is a quantity difference, there will

be a purchase price variance incurred on the journal transaction.

Depending on the variance, the transaction can be a gain or loss.

The company has the option for the amount to remain as a variance

or allocated to current period production if required.

| |

Received Quantity > PO Quantity |

|

Received Quantity < PO Quantity |

| DEBIT |

Product

Inventory |

DEBIT |

Product

Inventory |

| CREDIT |

Accounts

Payable Accrual |

CREDIT |

Accounts

Payable Accrual |

| CREDIT |

Purchase

Price Variance |

DEBIT |

Purchase

Price Variance |

and select Pre Paid Invoice.

and select Pre Paid Invoice.

.

.

to save the prepaid purchase invoice and close the transaction.

to save the prepaid purchase invoice and close the transaction.