Credit memos are created from an existing invoice to generate a credit memo for an incorrect invoice transaction, thus reducing the amount payable to a vendor . Debit memos are created from an existing invoice to generate a debit memo for an incorrect invoice transaction, thus increasing the amount payable to the vendor. The steps outlined in this document will detail how to create a Credit Memo, but the process for creating credit memos and debit memos is the same. All amounts recorded on credit and debit memos will be allocated to purchase price variance accounts.

The following options are outlined in the Credit/Debit Memo:

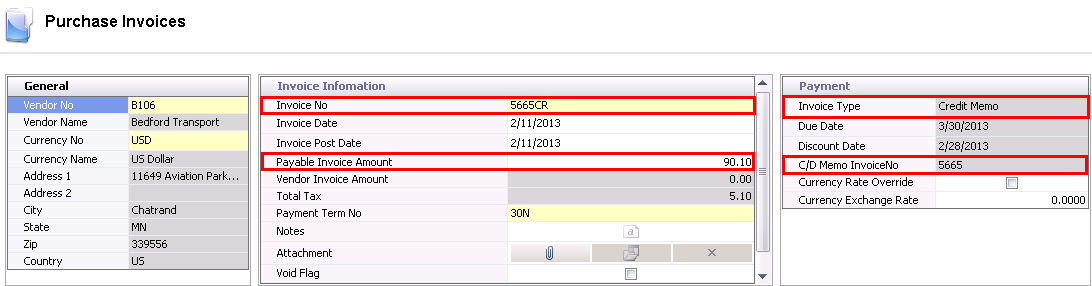

The header will default the header information that was defined on the original purchase invoice.

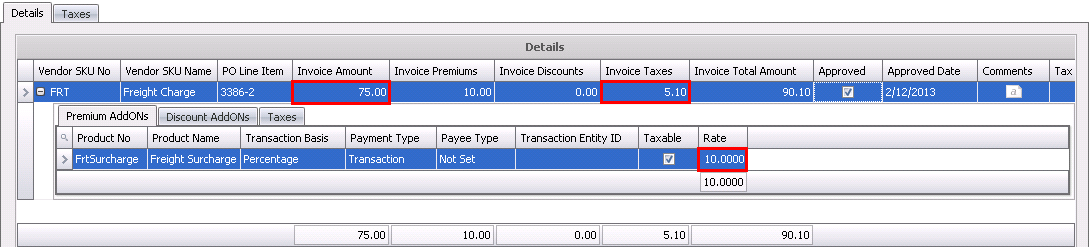

The line details default from the original invoice that was created. The user will enter the required values in the available fields.

Once the Debit or Credit Memo has been created and saved, the invoice needs to be posted. The posting process locks the purchase invoice to prevent edits, and creates the journal transaction to record the liability. The UnPost option unlocks the invoice and reverses the journal transactions.

In order for the debit or credit memo to be posted, it needs to be in Approved status.

The posting process creates the journal transaction. The journal will reverse the accounts payable accrual that was incurred when the product was received and record the payable amount to the vendor.

CREDIT MEMO |

DEBIT MEMO |

| Credit - Purchase Price Variance | Credit - Accounts Payable |

| Debit - Accounts Payable | Debit - Purchase Price Variance |