Journal transactions are generally created automatically in the system when a transaction is posted. A journal transaction automatically created will be assigned a Source Code. A transaction with a source code cannot be deleted or modified. If the source transaction is un-posted, the journal transaction is marked as Post Reversed and not considered a valid transaction.

Journal transactions can also be manually created to assign costs to cost centers and entities. Manually created journal transactions will not have a source code defined. Total debits and total credits must balance before the transaction can be saved and closed.

The following procedures are outlined in the Journal Transaction document:

In General>General>Transactions, select Journals.

Click the  button to create

a new journal transaction.

button to create

a new journal transaction.

Use the drop-down menu to select the Journal Type. Options available are:

|

|

|

|

|

|

|

|

|

Select the Entity Trans ID. Options will be filtered based on the selected Journal Type. For example, if Journal Type=Hatchery, the selection list will only display hatchery cost centers.

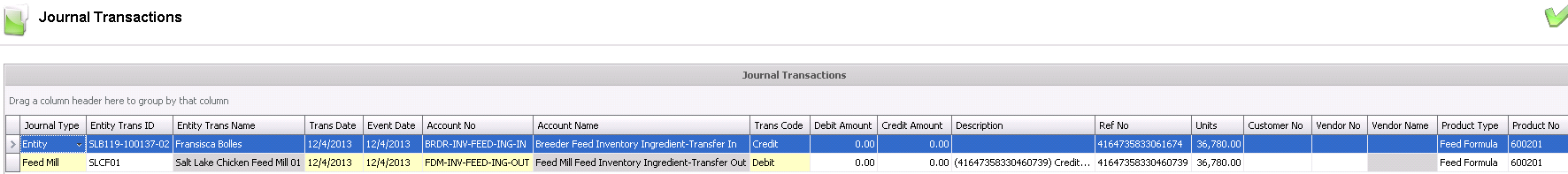

Entity Trans Name will default in from the selected entity trans ID.

Enter the Trans Date. This date will be used to post the transaction to the cost center.

Event Date will default to the same date as the trans date, and can be modified if required.

Select the Account No for the transaction. The Account No must be predefined in Admin>Business>Chart of Account Definitions.

Account Name will default in from the selected account no.

Trans Code can be manually selected or, alternatively, the option will default based on whether the amount is entered in the Debit Amount or Credit Amount column.

A Description can be entered for future reference to the journal.

Ref No is used to identify the journal transaction and will automatically default in.

If Units are required for the transaction, enter the number of units in the column.

Customer No is defined when the transaction is sourced from a sales transaction that is linked to a customer.

Vendor No is defined when the transaction is sourced from a purchase transaction that is linked to a vendor.

Vendor Name will display the name of the vendor.

Product Type can be selected if a product is required to be entered on the journal. If the journal is created from a source transaction, the Product Type will be derived.

The Product No can be selected based on the selected Product Type. If the journal is created from a source transaction, the Product Type will be derived from the transaction.

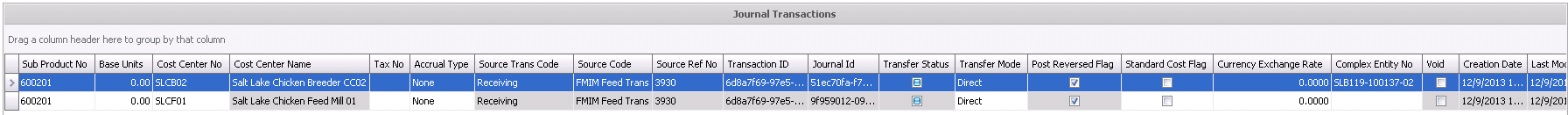

Sub Product No is generally only defined if the transaction is sourced from a system transaction. This field generally represents add-ons that are linked to a product for purchase and sales transactions.

Base Units indicates the number of units...

Cost Center No identifies the cost center in the transaction.

Cost Center Name displays a description of the cost center.

Tax No is only used for purchase and sales transactions and indicate the tax code that is used for the journal entry line.

Accrual Type is automatically defined based on the type of the transaction. The Accrual Type is used in period end to determine the transactions that are required to be reversed for the actual costs to be recorded. Options are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Source Trans Code is the transaction code for the original source transaction that this journal entry was derived from.

The Source Code is defined as the original source transaction type that this journal entry was derived from. Blank indicates a manually created journal record.

Source Ref No Indicates the original source transaction reference that this journal entry was derived from such as a receiving or invoice transaction. Blank indicates a manually created journal record.

Transaction ID is a system generated number that uniquely identifies the transaction within the system.

Journal ID is a system generated number that uniquely identifies the journal transaction and groups all of the journal transaction lines.

If Transfer Status is selected, the transaction represents a transfer out.

The Transfer Mode is automatically populated baaed on the type of transaction. Manual journals should only be set to Not Set or Direct. The Transfer Mode is used for filtering and reporting transactions. The following modes are available:

|

|

|

|

|

|

|

|

|

If a source transaction is un-posted, the journals must be reversed. When the journal is reversed from the un-posting, the Post Reversed flag is checked. This indicates that the journal is no longer valid.

Select the Standard Cost Flag if...

Currency Exchange Rate will be derived if the source transaction is a multi-currency transaction. The rate will either be derived based on the applicable rate defined in Exchange Rates or alternatively, the rate can be defined on the purchase order or purchase invoice.

Complex Entity No will default based on the selected Entity Trans ID. The field is not always populated depending on the type of transaction.

The Void flag nullifies the transaction. This field can only be selected in manual journal transactions. All other journals must be voided by voiding the original source transaction.

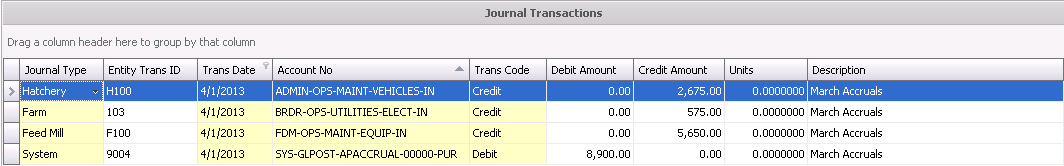

A reversing journal is used to reverse an accrual from a prior month or can be used to reverse any manual journal. The reversal option cannot be used for any journal transaction that has a source code.

Create a new journal as outlined in Create Journal Transaction.

Save and post the journal transaction.

Open the journal transaction to reverse.

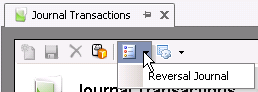

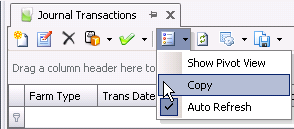

In the Journal Transactions edit screen, select

the Options  button and select `Reversal Journal`.

button and select `Reversal Journal`.

The date will prompt with the user with the journal date as the selected journal transaction date plus one day. For example, if the original journal was entered on 03/31/2013, the date prompt for the reversal will be 04/01/2013. The user can change this date as required.

Click OK to reverse the journal.

The Copy Journal option will copy any manual transaction. This may be used for journal transactions that have the same value recorded each month such as fixed asset depreciation. Journal transactions with a source code cannot be copied.

In the Journal Transaction index, select the journal transaction that is to be copied. Only one line from the journal needs to be selected.

Select Options>Copy.

The new journal date will default to the selected journal date. Modify the date prompt as required.

Click the OK button.

The process will create a copy of the selected journal transaction with the date entered in the date prompt.