Depreciation - Percentage

The BIM Depreciation Percentage calculates the depreciation expense

for the period when the percentage mode is used as a basis. The depreciation

is calculated based on the amortization table that is assigned to the

entity. The process credits accumulated depreciation and debits depreciation

expense.

The following options are discussed within this document:

Registry Options

There are several options available to configure the depreciation settings.

The switches are established by species.

- Salvage Value

Basis determines whether the salvage value is determined based

on per head or weight.

- Head

- calculates the salvage value based on a dollar amount per head.

- Percentage

of Capitalization Value - depreciates a percentage of the

capitalized value of the entity. For example, if the capitalized

cost of the entity is $100,000 and the percentage is 25%, the

depreciation expense for the entity will be 75%.

- Weight

- calculates the salvage value based on a dollar amount per lb

or dollar amount per kg depending on the unit of measure utilized

by the Division.

- Amortization

Salvage Mode defines the inventory basis for the salvage value.

The Projected End of Flock Inventory is based on the projected head

as defined by the head capitalized multiplied by the livability percentage.

Current Inventory is the other option that can be selected which bases

the salvage value on the current head inventory for the entity. This

option is commonly used in conjunction with the Expense Inventory

Depletion.

- If the Expense

Inventory Depletion option is selected, the depreciation task

will expense capitalized inventory for mortality and cull incurred

in the period. If the option is not selected, there will be no depreciation

expense for mortality and culls incurred in the period.

- Depreciation

Schedule Mode has two options available. By Flock requires

every entity to have an amortization table assigned. The period end

depreciation task will not calculate unless each entity has an amortization

table. By Product or Flock requires an amortization table to exist

for every product. There is an option to enter a specific amortization

table to an entity which will override the product amortization table

if required.

- Periodicity

determines if the amortization is calculated weekly or based on a

fiscal monthly period.

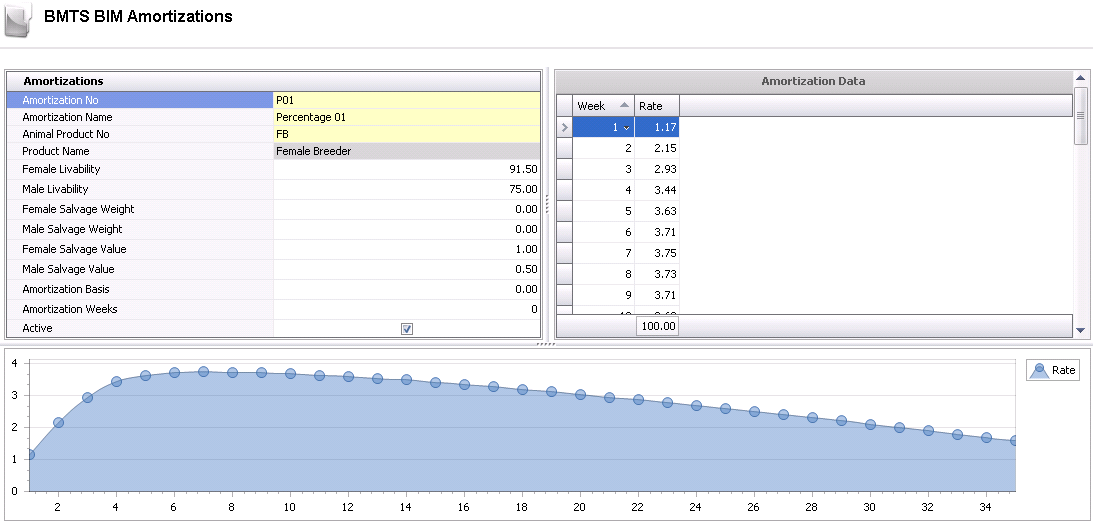

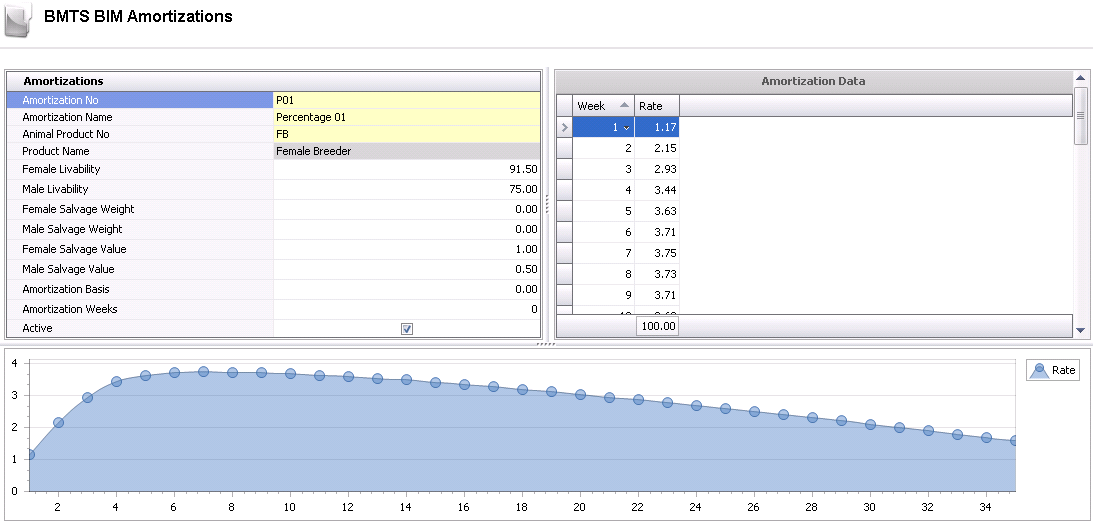

Amortization Table

The amortization table is created and assigned to the product. Although

the parameters are assigned by product, there are options in Master Data>Entity

to assign the parameters directly to the entity if the default parameters

need to be overridden.

The amortization screen is divided into two sections.

- Amortizations

- defines the product and the parameters relating to the amortization

table.

- Amortization Data

- grid to enter the curve data that calculates the depreciation amount.

- In Admin>Business>Poultry>BIM>Amortizations,

select

to create a new amortization table.

to create a new amortization table.

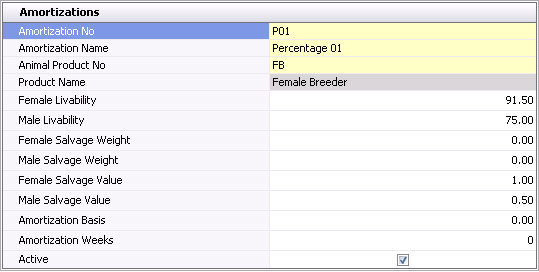

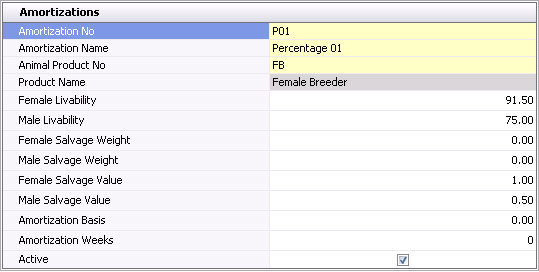

Amortizations

Amortizations defines the parameters related to product and amortization

method.

Enter the Amortization No to identify the

amortization table. (alphanumeric, max 20 characters)

In the Amortization

Name, enter the description for the amortization table. (alphanumeric,

max 50 characters)

Select the Animal Product No from the drop-down

list of available products. If the Depreciation Schedule Mode is set

to By Product or By Flock, the amortization table will be applied

to any entity with the defined product unless overridden by an amortization

table that is assign to a specific entity.

The Product

Name will be derived from the selected Product No.

Enter the Female Livability percentage. This

value will be used to determine the inventory for salvage value for

the entity if the Amortization Salvage Mode is set to Projected End

of Flock Inventory.

Enter the Male Livability percentage. This

value will be used to determine the inventory for salvage value for

the entity if the Amortization Salvage Mode is set to Projected End

of Flock Inventory.

Female

Salvage Weight is populated if the Salvage Value Basis

= Weight. Enter the

estimated female processing weight in pounds or kilos depending on

the unit of measure assigned to the Division.

Male

Salvage Weight is populated if the Salvage Value Basis

= Weight. Enter the

estimated male processing weight in pounds or kilos depending on the

unit of measure assigned to the Division.

Female

Salvage is the rate used to calculate the female salvage value

used to calculate depreciation basis. The value depends on the Salvage

Mode Basis.

Head

- enter the value per head processed to calculate salvage

value.

Percent

of Capitalized - enter the percentage of the capitalized

value that is used to calculate the salvage value.

Weight

- enter the value per pound or kilo process to calculate the salvage

value.

Male

Salvage is the rate used to calculate the male salvage value

used to calculate depreciation basis. The value depends on the Salvage

Mode Basis.

Head

- enter the value per head processed to calculate salvage

value.

Percent

of Capitalized - enter the percentage of the capitalized

value that is used to calculate the salvage value.

Weight

- enter the value per pound or kilo process to calculate the salvage

value.

Amortization

Basis is used in

the HE/HH method only and specifies the expected Accumulated HE per

HH at the end of the flock.

Amortization

Weeks specifies the number of weeks from capitalization to

the final date that amortization will be calculated for each

entity. This value overrides the number of weeks in the Amortization

Schedule for the Percentage Method.

- The Active

flag will default as selected. If the amortization table is no longer

used, de-select the active flag.

Amortization Data

The Amortization Data grid is used to enter the values for the depreciation

curve by week.

- Click on the Amortization grid and select

to add a new Week.

to add a new Week.

- In the Rate

field, enter the percentage for the weekly depreciation. The total

of all weeks must equal 100.00%.

Entity Master

The Depreciation

Schedule Mode determines the requirement of assigning

the amortization schedule to the entity. Within the entity, there is an

option to override the values established in .

The processes outlined in this section of the document are as follows:

Assign Amortization to

Entity

If the Depreciation Schedule Mode>By Entity is selected in the registry,

the following steps outline the process to assign the amortization table

to the entity. The amortization table must be assigned based on the period

end granularity. If the period end granularity is set Entity, the amortization

table needs to be assigned only to the Farm-Flock level. If period end

granularity is set to House, the amortization table needs to be assigned

only to each of the houses for the entity.

- In BIM>Master Data>Entities, click on the

required entity

- Right-click and select Add/Change Entities

- Select the line for the Entity level

- In the Amortization No field, click on the drop-down

and select the required Amortization No.

- If the period end granularity is set to Entity,

the process is complete. Otherwise, repeat the process for each house

if the period end granularity is set to House.

Modify Amortization

Details by Entity

The amortization details can be modified by entity if required. The

details entered in the entity will override any values entered in Amortizations.

- In BIM>Master Data>Entities, click on the

required entity

- Right-click and select Add/Change Entities

- Select the line for the Entity level

- Enter the amortization details based on the period

end granularity. If running period end by Entity, the values only

need to be entered at the entity level. If period end is being run

by house, then the values need to be entered for each house that needs

to override the default parameters.

Female

Salvage is the rate used to calculate the female salvage value

used to calculate depreciation basis. The value depends on the Salvage

Mode Basis.

Head

- enter the value per head processed to calculate salvage

value.

Percent

of Capitalized - enter the percentage of the capitalized

value that is used to calculate the salvage value.

Weight

- enter the value per pound or kilo process to calculate the salvage

value.

Male

Salvage is the rate used to calculate the male salvage value

used to calculate depreciation basis. The value depends on the Salvage

Mode Basis.

Head

- enter the value per head processed to calculate salvage

value.

Percent

of Capitalized - enter the percentage of the capitalized

value that is used to calculate the salvage value.

Weight

- enter the value per pound or kilo process to calculate the salvage

value.

Female

Salvage Weight is populated if the Salvage Value Basis = Weight. Enter the estimated female processing

weight in pounds or kilos depending on the unit of measure assigned

to the Division.

Male

Salvage Weight is populated if the Salvage Value Basis = Weight. Enter the estimated male processing

weight in pounds or kilos depending on the unit of measure assigned

to the Division.Enter the

Female

Livability percentage. This value will be used to determine

the inventory for salvage value for the entity if the Amortization

Salvage Mode is set to Projected End of Flock Inventory.

Enter the

Male

Livability percentage. This value will be used to determine

the inventory for salvage value for the entity if the Amortization

Salvage Mode is set to Projected End of Flock Inventory.

Amortization

Weeks specifies the number of weeks from capitalization to

the final date that amortization will be calculated for each

entity. This value overrides the number of weeks in the Amortization

Schedule for the Percentage Method.

Amortization

Basis is used in

the HE/HH method only and specifies the expected Accumulated HE per

HH at the end of the flock.

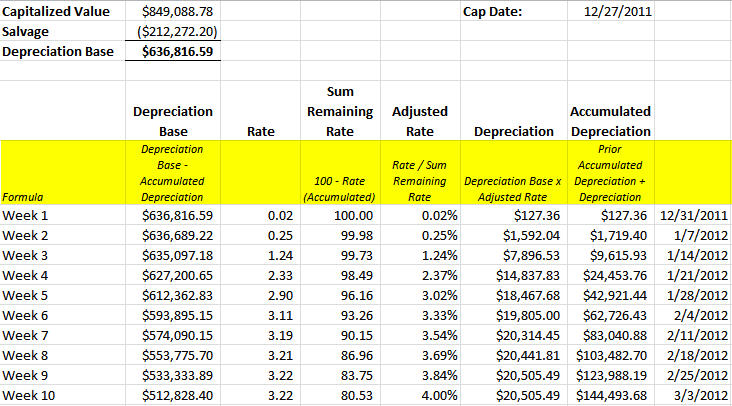

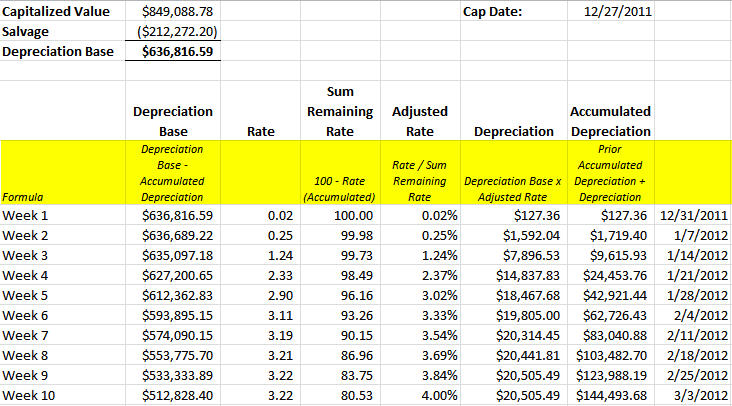

Depreciation Calculation

The depreciation calculation is based on the parameters established

in .

The calculation is based from the net book value of the entity and the

depreciation rate for the period. The depreciation is entered based on

a weekly rate, therefor if an entity is capitalized mid-week, the rate

will apply to the week that the entity is capitalized as well as the required

days in the following week until the number of days for the week are met.

This process will continue throughout the depreciation cycle of the entity.

Click here to view

the full calculation.

Period End Depreciation

Task

There is a depreciation task for each module and generation. Regardless

of the module and generation, the task processes in the same manner based

on the parameters defined in Amortization for the product or the table

that has been assigned to the entity. The purpose of the depreciation

task is to credit Accumulated Depreciation and debit Depreciation Expense

for each entity depreciated in the period.

- In the Period End Task list, select the depreciation

task required for the module and generation.

- Right-click and select Calculate to start the

task

- When the task is finished, the Complete option

with be selected

Available Journals

Once the task has been completed, the user is able to view the journals.

- Click on the depreciation task that has the Complete

flag selected.

- Right-click and select Available Journals

- The journals that are created from the depreciation

task:

| DEBIT |

Depreciation

Expense |

CREDIT |

Accumulated

Depreciation |

- The journal screen can be filtered, sorted and

grouped to view the details as required.

Depreciation Log

The Depreciation Log is created from the depreciation task. The Depreciation

Log contains data specific to the entity to audit the depreciation amount

for the period.

- Click on the depreciation task that has the Complete

flag selected.

- Right-click and select Depreciation Percent Log.

- The Depreciation Percent Log displays the depreciation

details for the fiscal period based on the period end granularity.

There are several fields available in the log to audit the period

depreciation expense. The log can be filtered, sorted and grouped

as required.

- Complex Entity

No indicates the entity that incurred the depreciation in the

fiscal period. The entity will be at the granularity as defined for

period end in Poultry Registry.

- Cost Center No

is derived based on the cost center assigned to the farm for the entity.

- Begin Date

is the first date of the fiscal period.

- End Date

is the last date of the fiscal period.

- Month

represents the fiscal period as defined in the Fiscal Calendar.

- Fiscal Year

represents the fiscal year for the depreciation expense as defined

in Fiscal

Calendar.

- The date that the entity was capitalized is indicated

in the Date Cap column.

- First Date

represents the first date in the current period that the depreciation

expense is incurred. For entities capitalized in prior months, this

date will always be the first date of the fiscal period. If the entity

was capitalized in the period, the date will be the capitalized date

as that is the date that the depreciation calculation begins.

- Final Date

is the calculated last date for depreciation date for the entity.

- Date represents

the date on the journal transaction for the depreciation expense.

If the Poultry Registry>Periodicity is defined as Monthly, there

will be one journal created per entity for the fiscal month. f the

Poultry Registry>Periodicity is defined as Weekly, there will be

one journal created for each week in the fiscal month.

- Depreciation

Amount is the calculated depreciation for the entity for the

period as based on the amortization table assigned to the entity.

Depreciation Amount = Amount Left to Depreciate

x Depreciation Units

- Depreciation

Units is the calculated

depreciation rate for the period.

- Net Book Value

is the capitalized value of the entity less accumulated depreciation.

The estimated salvage is not included in Net Book Value.

- Salvage Amount

is the amount of salvage that is expected to be incurred for the entity.

- Amount Left to

Depreciate is the capitalized value of the entity less accumulated

depreciation less estimated salvage value. This value is used to calculate

the period deprecation.

- Current Raw Amort Rate represents

the value directly from the amortization table. The table

is weekly and depreciation is monthly, so the program calculates a

monthly summed value that prorates partial weeks to calculate a monthly

rate. This calculation is also age aligned, so the weeks

are matched to flock age, not calendar weeks.

- The

percentage remaining to depreciate is represents in the Remaining

Amort Percent column. The value is calculated as the sum of the

remaining rates from the table, including the current period. If

the flock is at 50 weeks on the period begin date and will be amortized

to week 60, then Remaining Amort Percent would be the sum of the rates

from week 50 to week 60.

- Current Adjusted Amort Rate

is the calculated depreciation rate for the period. The value is calculated

as defined in the example below.

Current

Raw Amort Rate = 10.91.

Remaining

Amort Percent = 46.66.

Current

Adjusted Amort Rate = 10.91 / 46.66 = 0.2338191170167167

0.2338191170167167

x (NBV-Salvage) = Depreciation

- The Message

column is used to display any error message or required details that

occurred in the calculation of the depreciation.

- The base details of the calculation are displayed

in the Description field.

- Generation

is derived based on the entity.

- Amortization

No represents the amortization that is being used by the entity.

Depending on the option selected in the Depreciation

Schedule Mode, the amortization table will be

derived from the product assigned to the entity or the amortization

table assigned to the entity.

- The Female Livability

represents the livability percentage that has been entered for females

in Amortization.

- The Male Livability

represents the livability percentage that has been entered for males

in Amortization.

- Female Salvage

Value is the rate used to calculate the female salvage value

used to calculate depreciation basis. The value depends on the Salvage

Mode Basis.

Head

- enter the value per head processed to calculate salvage

value.

Percent

of Capitalized - enter the percentage of the capitalized

value that is used to calculate the salvage value.

Weight

- enter the value per pound or kilo process to calculate the salvage

value.

- Male Salvage

Value is the rate used to calculate the male salvage value

used to calculate depreciation basis. The value depends on the Salvage

Mode Basis.

Head

- enter the value per head processed to calculate salvage

value.

Percent

of Capitalized - enter the percentage of the capitalized

value that is used to calculate the salvage value.

Weight

- enter the value per pound or kilo process to calculate the salvage

value.

- If birds are capitalized mid-week, the depreciation

calculation is required to depreciate over two weekly factors. First Depreciation Week No represents

the first week in the amortization table that is used in the depreciation

calculation.

- If birds are capitalized mid-week, the depreciation

calculation is required to depreciate over two weekly factors. End Depreciation Week No represents

the first week in the amortization table that is used in the depreciation

calculation.

- If birds are capitalized mid-week, the depreciation

calculation is required to depreciate over two weekly factors. First Depreciation Rate represents

the rate of the first week in the amortization table that is used

in the depreciation calculation.

- If birds are capitalized mid-week, the depreciation

calculation is required to depreciate over two weekly factors. End Depreciation Rate represents

the rate of the second week in the amortization table that is used

in the depreciation calculation.

- Depl Amount Sales

indicates the dollar value of the spent breeders sold in the period.

- Depl Units Sales

indicates the number of the spent breeders sold in the period.

- Depl Amount Mort&Cull

indicates the dollar value of the birds that were entered in the mortality

and cull fields in Field Transactions.

- Depl Units Mort&Cull

indicates the number of birds that were entered in the mortality and

cull fields in Field Transactions.

![]()

to create a new amortization table.

to create a new amortization table.

to add a new Week.

to add a new Week.